The Gist

- Customers as assets. When we see customers as long-term assets, not just purchasers, we bring critical value to every CX investment opportunity.

- The C-Suite’s imperative. We need CX programs to evolve beyond sentiment scores and into a conversation that resonates with financial outcomes and C-suite imperatives.

- The Customer Asset Model. Bridge the gap between CX and ROI, increasing your investment performance and opportunity to drive new customer value.

The customer experience and its return on investment have long suffered from the inability to answer a fundamental question: What does the C-suite truly value? We want great customer experiences because we believe they directly promote brand loyalty and lifetime value.

However, when the conversation turns into investing in these operations, we struggle when sentiment scores fail to translate into financial outcomes.

But rather than sacrificing CX for financial returns or vice-versa, what if there was a proven framework that not only kept both integral performance views, but bridged the gap between them, directly aligning with the business outcomes that the C-Suite desires?

Let's explore how the Customer Asset Model powers up your CX and ROI programs by focusing on value and relational worth.

Table of Contents

- Our Fundamental Misalignment of Customer Value

- Value’s Missing Link Between CX and ROI

- FAQ on Customer Asset Model and CX ROI

- Customer Asset Model: 3 Benefits of Integrating the CX ROI Divide

- 3 Steps to Build Your Customer Asset Value Model

- Beyond the Features: Integration Defined – The Customer Asset Model

- Putting the Customer Asset Model to Work for Your Business

Our Fundamental Misalignment of Customer Value

Modern organizations operate under a profound and costly misconception: that customer experience is best measured by sentiment, rather than as a tangible driver of financial health toward a defined business outcome. This perspective creates a fundamental misalignment in how we value the customer, separating CX initiatives from the critical business outcomes the C-Suite cares about most.

Let’s delve into three significant reasons that disconnect CX from the core pillars of business success: growth, return and health.

Value’s Missing Link Between CX and ROI

Translating CX Metrics Into Business Outcomes

This table highlights how common CX metrics can evolve from sentiment-based indicators into meaningful financial outcomes that speak the C-suite’s language.

| CX Metric | What It Measures | Business Translation |

|---|---|---|

| CSAT (Customer Satisfaction Score) | Customer sentiment immediately after an interaction | Links to reduced churn and higher renewal rates |

| NPS (Net Promoter Score) | Likelihood of customers to recommend your brand | Correlates with organic growth through advocacy and referrals |

| CES (Customer Effort Score) | Ease of completing a customer task | Connects to lower service costs and improved operational efficiency |

| Customer Lifetime Value (CLV) | Total expected revenue from a customer over time | Reframes customers as long-term assets contributing to growth |

| Churn Rate | Percentage of customers lost over a given period | Quantifies the cost of poor experience and revenue leakage |

We've been trained to rely on CSAT and NPS to gauge customer sentiment. But these scores, viewed in isolation, hold little value for the C-suite. A high score doesn't tell a CFO if a CX initiative is a worthy investment because it fails to speak the language of return, growth and health.

Value’s missing link between CX and ROI isn’t a better score, but a tangible business outcome. Reframing the conversation from "Our CSAT is up" to "Investing $X in this service will reduce churn by 5% and increase revenue by $Y” provokes the investment conversation by connecting a measurable impact that captures the C-suite's attention.

Related Article: The One-Dial Illusion: Why CX Leaders Keep Crashing on ROI

Customers Aren’t Assets. Cost Centers Aren’t Value Centers

A significant obstacle to driving value is our fundamental perspective on the customer base. Due to scarce capital and a "managing to the quarter" mentality, many organizations prioritize short-term financial sprints and place a premium on expense management.

This view causes us to see our customers merely as one-time purchasers rather than long-term assets to be nurtured. Consequently, CX initiatives are often labeled as expenses rather than strategic investments. Under these flawed perspectives, there is rarely an amount of return that will justify an investment when the customer is viewed as a transaction, not a source of compounding value.

A Critical Lack of Focus on Relational Health and Worth

The culmination of these misalignments creates a substantial lack of focus on relational health and worth. Because we don't believe we can measure the long-term value of a customer relationship, we tend to limit the time we spend on nurturing it.

But we absolutely can measure it. Nurturing customers, solving their problems and driving value does far more than just foster lasting partnerships. It fuels customer loyalty, which, in turn, drives customer advocacy—the most powerful growth engine available. By shifting our perspective to relational health, we uncover the ultimate multiplier effect, one that delivers a return far greater than a customer's initial investment.

FAQ on Customer Asset Model and CX ROI

Here are five questions and answers to consider when it comes to customer experience ROI and the Customer Asset Model.

Start by mapping CX and ROI variables, identifying growth levers, and running predictive simulations to forecast impact. This approach enables proactive, data-driven investment decisions that elevate CX from sentiment to measurable enterprise value. The model integrates CX metrics with financial indicators, allowing leaders to link every customer interaction to tangible business outcomes. This eliminates silos between experience and finance, creating a shared language that drives measurable growth. It eliminates the CX-ROI divide, creates sustainable customer value, and transforms CX from a cost center into a compounding growth engine. The model drives strategic collaboration and ensures every CX investment contributes directly to business performance. The Customer Asset Model is a framework that unifies customer experience (CX) and return on investment (ROI). It helps organizations view customers as long-term assets rather than one-time purchasers, aligning CX initiatives directly with financial outcomes valued by the C-suite. Most organizations measure CX through sentiment metrics like NPS or CSAT, which rarely translate into financial impact. This separation prevents CX teams from proving value in C-suite terms such as growth, return and health.

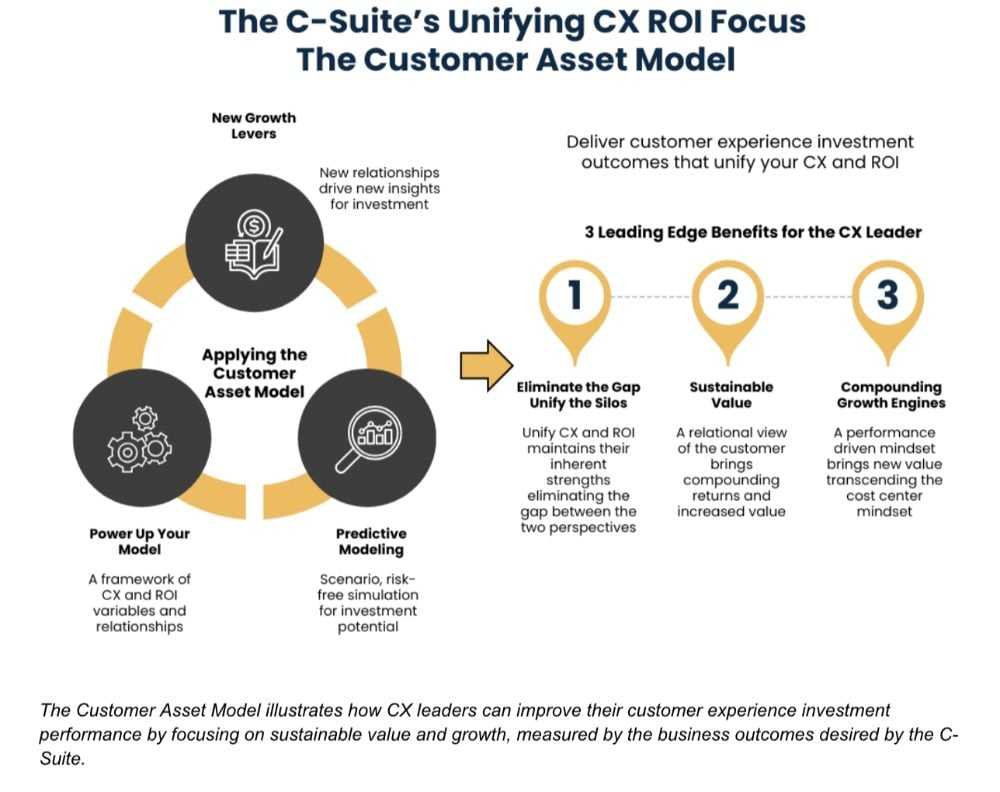

Customer Asset Model: 3 Benefits of Integrating the CX ROI Divide

The Customer Asset Model is the strategic solution to the fundamental misalignment we've identified. This framework enables you to transform CX from a cost center into a compounding growth engine. By integrating CX with the financial language of the C-suite, this model provides the blueprint for building sustainable, long-term customer value.

Let's explore the three key, leading-edge benefits that the Customer Asset Model delivers in integrating the CX ROI divide.

Eliminate the Gap. Unify the Silos

Rather than trying to fix a single metric or focusing solely on CX or ROI in isolation, the Customer Asset Model unifies their inherent strengths and eliminates the gap between the two perspectives.

Integrating CX with financial metrics accomplishes two key things:

- It lends critical financial credibility to your CX metrics

- It provides the needed customer context for financial investment and performance

This isn't a new reporting tactic; it's a strategic perspective that transitions the conversation from a fight for budget to a partnership focused on building customer value. This new collaboration drives long-term revenue, strengthens the brand and elevates the importance of both disciplines within the organization.

Related Article: Top Customer Experience Metrics That Matter Today

A Sustainable Focus to Drive Sustainable Value

A "manage to the numbers" mindset only delivers short-lived success. Your customers’ needs continually evolve, and the Customer Asset Model drives the value that your customers seek. The model enables a more progressive, durable and strategic approach to decision-making. By adopting a relational view of the customer, leaders can make informed, data-backed investments with a high potential for compounding returns. Proactively and continually evaluating opportunities, optimizing performance and building an engine for sustainable, long-term value moves your organization beyond a quarterly mindset and focuses on sustainable growth and value.

From Cost Centers to Compounding Growth Engines

The ultimate benefit of the Customer Asset Model is that it transforms a perceived cost center into a powerful, self-sustaining growth engine. Many organizations manage customer experience as a drain on resources, yielding minimal, if any, measurable returns.

But by transitioning to a performance-driven mindset, this framework of unifying CX and ROI provides the ability to identify, measure and continuously improve every customer investment from beginning to end. It’s no longer about justifying an expense; it’s about strategically allocating precious capital to a core asset that delivers a powerful, compounding return on investment, fueling organic growth for the entire organization.

Related Article: CSAT Just Won't Pay the Bills

3 Steps to Build Your Customer Asset Value Model

Building the Customer Asset Model requires more than just identifying your variables. It requires an integrated, meaningful approach. Here are three key strategies you can implement right now to build and power up your model, enabling you to unify CX and ROI to deliver maximum value.

Power Up Your Model - The Customer Asset Value Map

Build your model by identifying your core CX and ROI variables and relationships, uniting them beyond isolated metrics into a consolidated framework:

- First, identify your key CX variables around engagement frequency, service touchpoints and advocacy behaviors.

- Next, define your financial variables around customer lifetime value, cost to serve and referral rates.

- Lastly, define the relationships between these two sets of data that represent your new shared language, which now links every customer interaction to a tangible business outcome and shared measure of success.

Identify — and Exploit — Your New Growth Levers

Now that your model is built, don’t settle for just measuring what you know. Use your model as a powerful discovery tool to analyze relationships between CX and ROI to uncover previously unseen (or undetermined) growth levers. For example, your analysis might reveal that a delay in customer onboarding does have a direct and high impact on a customer’s long-term value, or that reducing friction in a specific customer channel directly reduces customer churn. Developing new insights results in new investment opportunities, which you can use to better serve your customers and further increase customer intimacy.

Compounding Customer Value: Predictive Modeling

Leading companies rely on scenario planning to model and test before executing. Use your Customer Asset Model for powerful simulation, before you allocate any budget or commit to investment. The model you’ve constructed allows you to analyze different investment scenarios to understand their potential impact on your customer asset value. Whether it’s a new self-service portal or the effects of a new product launch, your constructed model can forecast and provide you with critical insight. This approach moves you from reactive budgeting to a proactive, data-driven execution, ensuring every investment is a deliberate step toward building your customer base and delivering maximum value.

Beyond the Features: Integration Defined – The Customer Asset Model

This table distills the article’s core concepts on strengthening customer experience investment outcomes through the Customer Asset Model, helping CX leaders drive enterprise performance and measurable business results.

| Strategy element | Insight | Why it matters |

|---|---|---|

| Customers as assets | Managing to the quarter with short-term goals limits the view of customers as mere purchasers. | Elevating customers to assets brings long-term value to the center of every CX investment decision. |

| The CX and ROI divide | Many organizations focus on CX or ROI in isolation, refining metrics without closing the gap between them. | Connecting CX and ROI aligns measurement with the C-suite’s business imperatives and financial outcomes. |

| From cost centers to growth engines | Traditional CX operations are often viewed as cost centers that deliver limited financial return. | The Customer Asset Model reframes CX as a growth engine, linking experience to tangible business value. |

| Identifying new growth levers | Organizations tend to invest in familiar CX initiatives rather than exploring new opportunities. | The model enables evaluation of emerging initiatives by integrating CX and ROI metrics for smarter investment decisions. |

| Risk-free predictive modeling | Scenario planning is often reactive and limited to a small group of decision-makers. | The model supports proactive, risk-free simulations to test CX opportunities before committing resources. |

Putting the Customer Asset Model to Work for Your Business

The performance gap between CX and ROI is very real, particularly as the C-suite views CX as a siloed function, unable to justify its real value in terms of return, growth, and health.

However, by adopting the Customer Asset Model, you’re now armed with the framework to bridge the divide, propel growth and leverage the benefits of both CX and ROI without devaluing one or the other.

Commit to the Customer Asset Model and consistently apply the key strategies outlined here. You will uncover new, impactful benefits that deliver real value and solve pressing business problems, ultimately setting your business apart in any market.

Learn how you can join our contributor community.