The Gist:

- IRS service transformation. The IRS is working to overhaul its customer service by launching "Taxpayer 360," a new platform designed to provide a more seamless and efficient experience for both taxpayers and customer service representatives.

- Addressing long waits.Years of underinvestment led to long wait times and poor customer experiences. Inflation Reduction Act funding aims to fix these issues by modernizing IRS technology and processes.

- Focus on personalization.The IRS plans to offer personalized support by consolidating data into a single interface, enabling representatives to quickly access all relevant taxpayer information.

Several years ago, I founded a nonprofit aligned with the charitable aims of the CIO organization I facilitate. When it came time to file tax returns, both the IRS and the State Franchise Tax Board rejected our filings. I reached out to the state but was ultimately directed to the IRS.

Despite some trepidation, the IRS representative was surprisingly helpful. I shared that we were incorporated on Sept. 19, but the state didn’t approve the incorporation until November, and the IRS approval wasn’t until March. After navigating multiple systems, the agent said that our fiscal year was set from Oct. 1 through Sept. 30.

This experience left me intrigued by the IRS’s ongoing efforts to enhance IRS customer service, a topic explored at the Chief Data Officer and Information Quality (CDOIQ) Symposium.

Improving IRS Customer Service Through Employee Experience

In "The Experience Mindset," Tiffani Bova emphasized that employees embody and execute the core values and mission of their organization daily. Their experiences directly influence the quality of services they provide, affecting every customer interaction. This raises an important question: What was the experience like for IRS taxpayer service representatives?

Unfortunately, the IRS had been plagued by years of underinvestment, which led to a poor taxpayer experience across the board. This disinvestment resulted in outdated, siloed technology that made it challenging to meet taxpayer expectations. The situation was dire by 2022 — only 15% of taxpayer calls were answered, with an average wait time of 28 minutes. Notifications were often sent by mail and difficult to understand, and they lacked self-service options, further complicating the taxpayer experience.

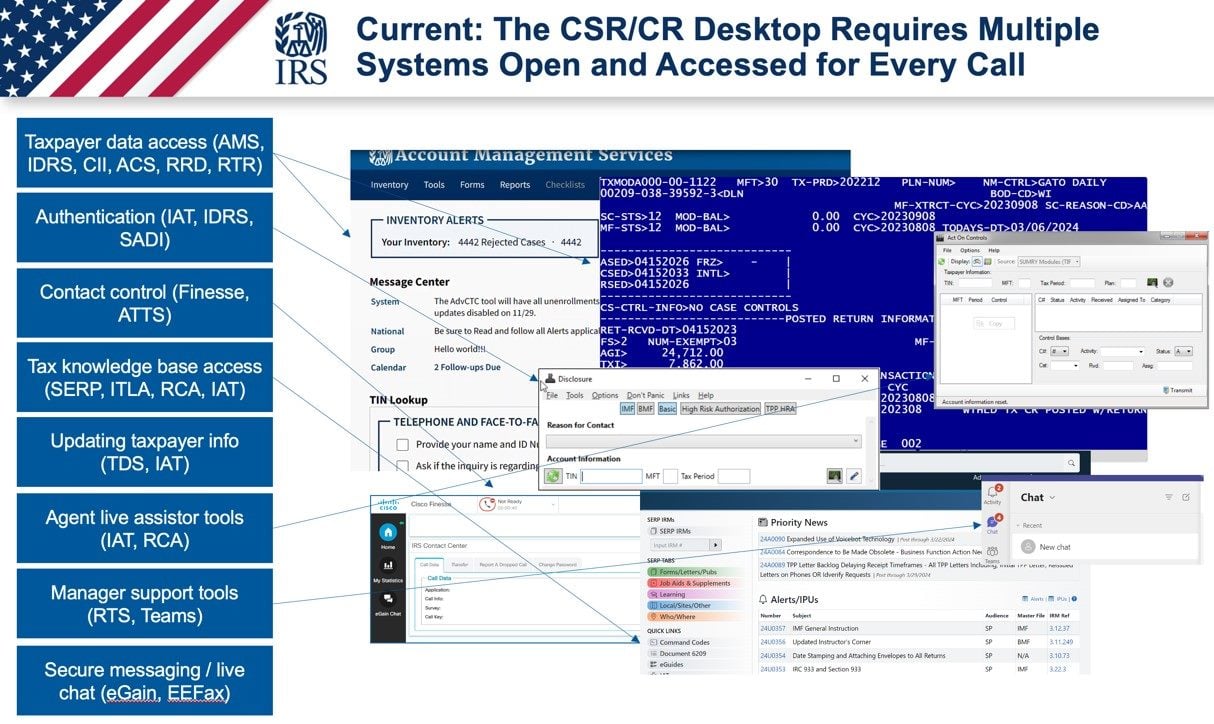

The representatives tasked with assisting taxpayers faced significant hurdles. They had to navigate a complex, disjointed system that required them to act as manual ETL (Extract, Transform, Load) tools, transferring data between as many as eight different systems during a single call.

This inefficiency means that a simple query could involve greeting the taxpayer, authenticating them and then spending up to five minutes pulling together the necessary information. The process was cumbersome. Taxpayers were often put on hold as representatives juggled multiple systems, input data and struggled to resolve issues in a non-integrated environment.

Enter the Inflation Reduction Act, which provided historic funding to tackle these challenges head-on, aiming to transform the taxpayer experience by addressing systemic inefficiencies and upgrading the IRS’s outdated technological backbone.

Related Article: 5 Strategies for the New Era of Customer Support

Introducing Taxpayer 360: A Game Changer for IRS Customer Service

The goal of Taxpayer 360 is to revolutionize IRS customer service by providing a comprehensive, persona-based single-access point for customer service representatives (CSRs).

Melanie Krause, the IRS’s first chief operating officer, said, “Taxpayer 360 has the potential to make it dramatically easier for IRS customer support representatives to quickly answer taxpayers’ questions, which will significantly improve call experiences for taxpayers and their representatives. Taxpayer 360 is an example of the Inflation Reduction Act dollars being used to yield tangible improvements to taxpayer service.”

The goal of Taxpayer 360 is to consolidate historical, transactional and taxpayer data into one streamlined interface, ensuring that the right information is available at the right time. This approach not only promises to enhance the efficiency of issue resolution for taxpayers but also aims to make the IRS's operations smoother and more responsive.

Given that call center employees represent the largest taxpayer-facing workforce within the IRS, with over 20,000 CSRs, they will be the primary focus for the initial rollout of Taxpayer 360. By integrating this vast array of data into a single pane of glass, the IRS seeks to empower CSRs to deliver a more personalized experience. As highlighted in the upcoming book "Personalized: Customer Strategy in the Age of AI” by Mark Abraham and David C. Edelman, “personalization starts with the collection, integration, enrichment and management of customer data.”

Taxpayer 360 embodies this principle, allowing agents to access all relevant information about a taxpayer and enhancing their ability to provide tailored service. It provides the right data at the right time, in the format needed to enable more efficient issue resolution for taxpayers and the IRS.

Personalization starts when an agent has all relevant tax-related information about the taxpayer and their history with the company at their fingertips. Key features of Taxpayer 360 include a single sign-on interface, the capability to capture authentication and authorization details while customers are waiting and the use of assistor bots to pull up contextual information during calls. The system also integrates natural language processing, enabling CSRs to search for information in plain English.

With AI-generated call notes and a searchable dropdown of call types, the goal of Taxpayer 360 is to provide high-quality, efficient service, creating a seamless and responsive experience for both taxpayers and CSRs. Taxpayer 360 aims to reduce wait times and hold times when taxpayers call the IRS. Taxpayer 360 will focus on addressing hold times during the calls themselves, as well as helping customer service reps to more quickly find the right information to relay.

Related Article: 11 Top Customer Service Metrics to Measure

The Future of Taxpayer Customer Experience

Many people have trepidation about contacting the IRS, but when they got the courage to call, the experience historically has not been great. The IRS’s chronic underinvestment resulted in a disjointed system that frustrated both taxpayers and IRS representatives.

To address these issues, the IRS is introducing Taxpayer 360 to revolutionize its customer service by creating a single, integrated interface for CSRs. The goal of this system is to allow CSRs to provide personalized and efficient service. With over 20,000 call center employees, Taxpayer 360 will streamline processes and ultimately improve the overall IRS customer service by ensuring that agents have all the information needed at their fingertips.

The good news is that the IRS has already begun to test Taxpayer 360 and aims to launch its first pilot in 2025 before rolling out broader usage for all taxpayer calls and eventually taxpayers.

Learn how you can join our contributor community.