The Gist

- Shift from efficiency to effectiveness metrics. Current martech metrics are not doing the job.

- Treat martech differently across industries. We take marketing automation as an example to show how martech plays a very different role across industries.

- The Martech Value Matrix for TelCo stacks. The Martech Value Metric shows where martech maturity increases or reduces company value.

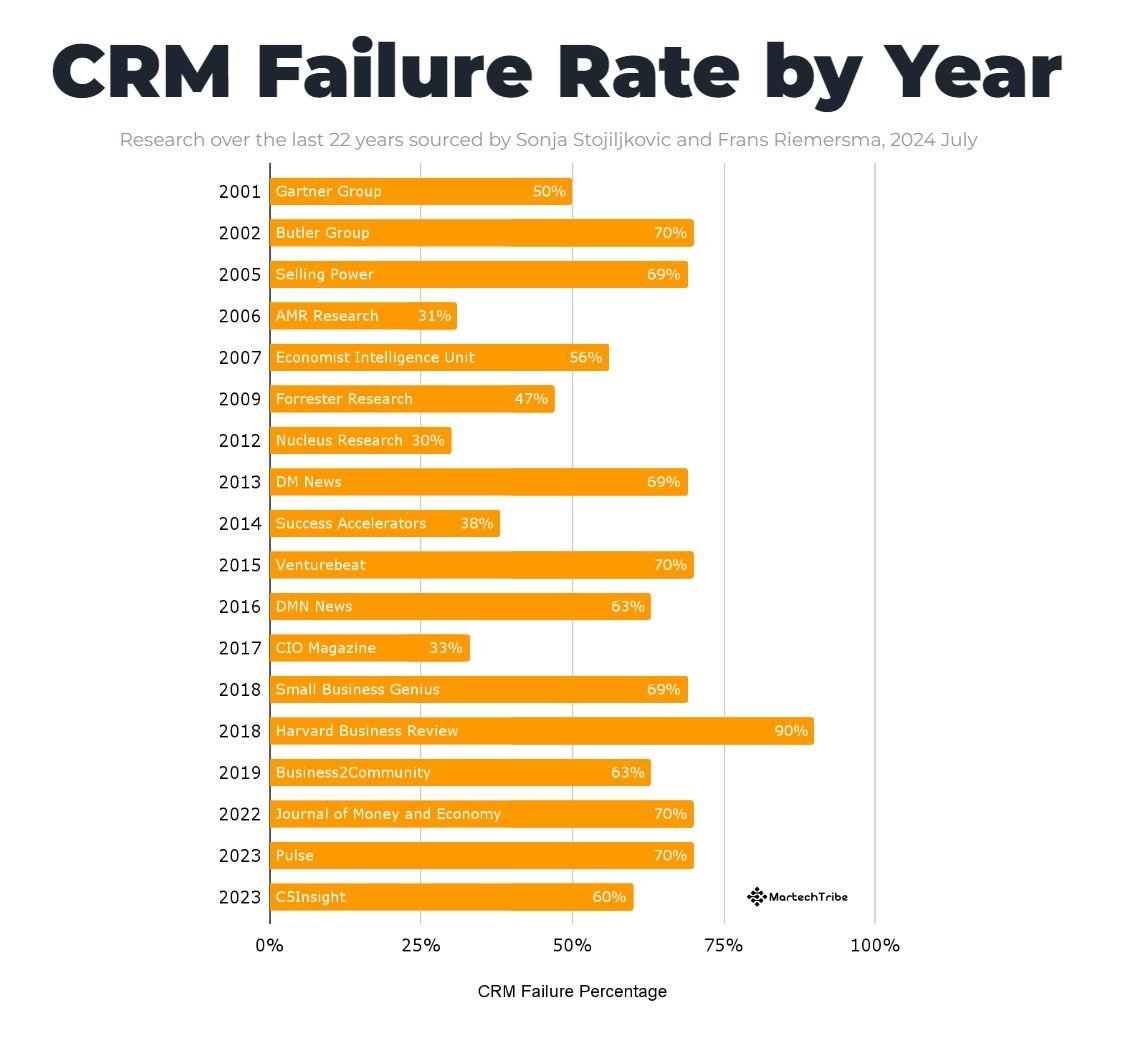

Why do we need a martech metrics? Well, the boardroom and other departments outside marketing have raised eyebrows for decades. They were backed up by low-success statistics battering the martech budgets.

Take CRM: for over 20 years renowned research institutes have painfully exposed the failures in CRM. Let’s admit, this does not look good. Let's take a look at the Martech Value Matrix.

The problem is that it leaves martech in a vulnerable spot when budget cuts are just around the corner. We need a metric to demonstrate the value of martech.

Related Article: Marketing Technology Landscape Grows to 14,106 Solutions

How Are the Existing Martech Value Metrics Doing?

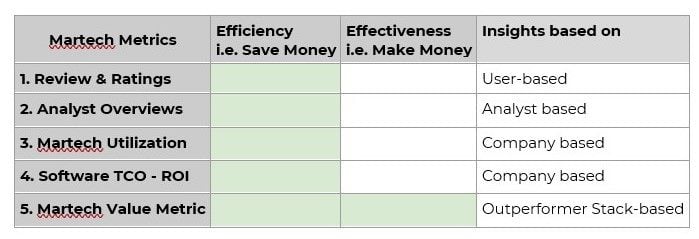

Today there are a few martech metrics out there to make a case for martech.

First of all, there are anecdotal user reviews and interview-based software overviews by analysts. The challenge with anecdotal user reviews and analysts' overviews is that they do not consider the company-specific and unique conditions, making it less convincing to internal stakeholders.

Then there are methods like calculating the martech utilization rate, and Total Cost of Ownership (TCO). It is reported that companies only “utilize” 33% of their martech capabilities. The challenge with martech utilization is that it focuses on the use of software, instead of the value it creates for the company. The same applies to Total Cost of Ownership (TCO).

However interesting, these metrics do not reveal how to “get value from martech.” The focus is on efficiency, not effectiveness. Efficiency is about "doing things right" to save money, and, as a result, its focus is inwardly on the company. Effectiveness is about "doing the right things" to make money with an outward focus on the customer. Efficiency is good, but effectiveness is so much better for making a compelling business case. We have to change our perspective. We have to go from the defense into the offense.

The Martech Value Metric

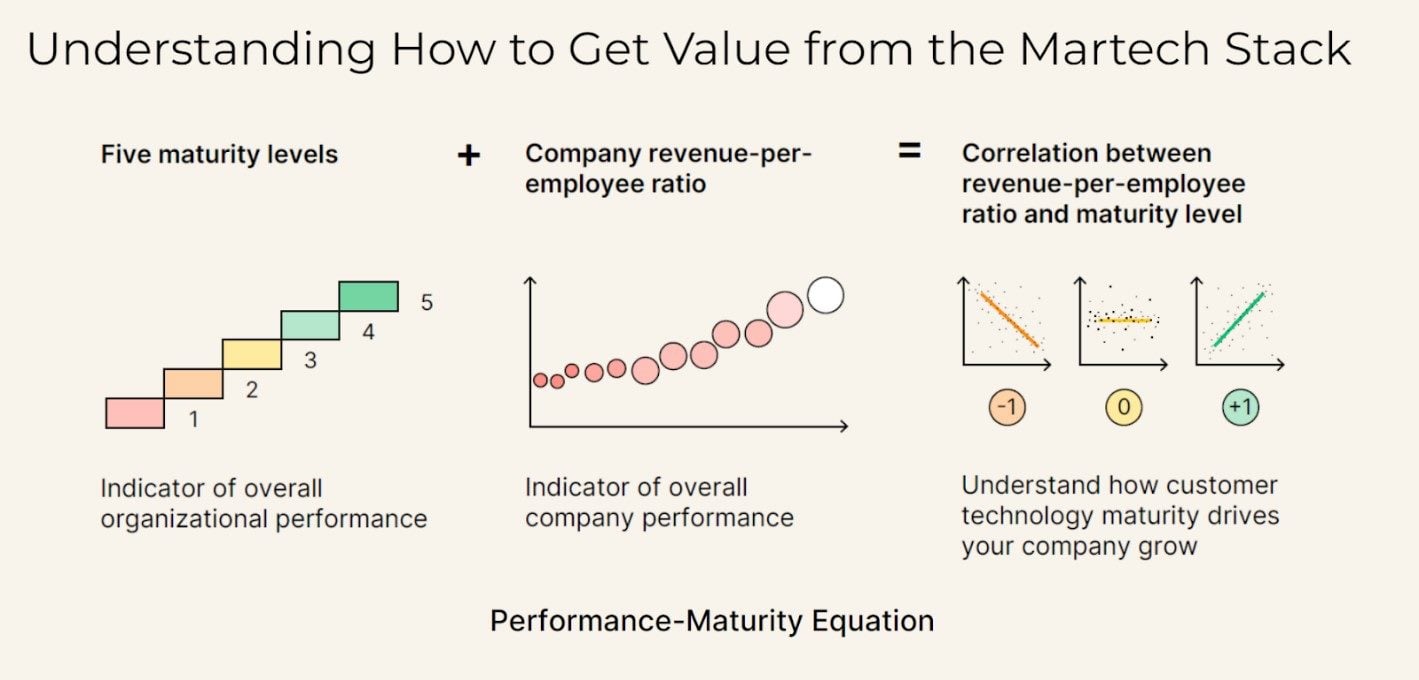

Linking martech to effectiveness is to link martech investments directly to business performance. Our research from the last five years established a practical martech metric and offers some promising insights into the connection between martech and company value. The new metric combines both external and internal company performance.

- Company Performance: Measured by the revenue-per-employee ratio, offering a comparative view of company performance within its industry.

- Martech Performance: Assessed using a Likert scale based on the Capability Maturity Model from Carnegie Mellon University, evaluating the maturity of martech capabilities within the company.

Related Article: How Effective Are Marketers at Using Martech Tools?

When correlating both the performance metrics there are three possible outcomes.

- Positive correlation: Greater maturity correlates with a higher revenue-per-employee ratio.

- Negative correlation: Greater maturity relates to a lower revenue-per-employee ratio.

- No significant impact: Maturity does not significantly change with the revenue-per-employee ratio.

The metric was based on research we conducted over the past five years. Our team has explored the relationships between software vendor size, company stack size, revenue, headcount, industry, business model and specific martech components.

We've conducted hundreds of data experiments with a team of data scientists, leveraging our martech data warehouse. This warehouse houses 14,106 customer technology tools, 1,356 global, real-life, cross-industry customer technology stacks, and 4,758 requirements, and is continuously curated by over 467 experts across 30 countries.

In summary, we found the following insights.

- Martech usage varies significantly across industries.

- Martech is employed differently based on their approach: B2C, B2B and B2B2C.

- Martech usage shows slight variations by company size, including revenue and headcount.

- Top performers exhibit consistent martech investment patterns. Top performers are defined as the top 30% of companies in one industry ranked by revenue-per-employee ratio.

Related Article: Choosing Martech Solutions by the Data Value They Provide

Treat Martech Differently Across Industries

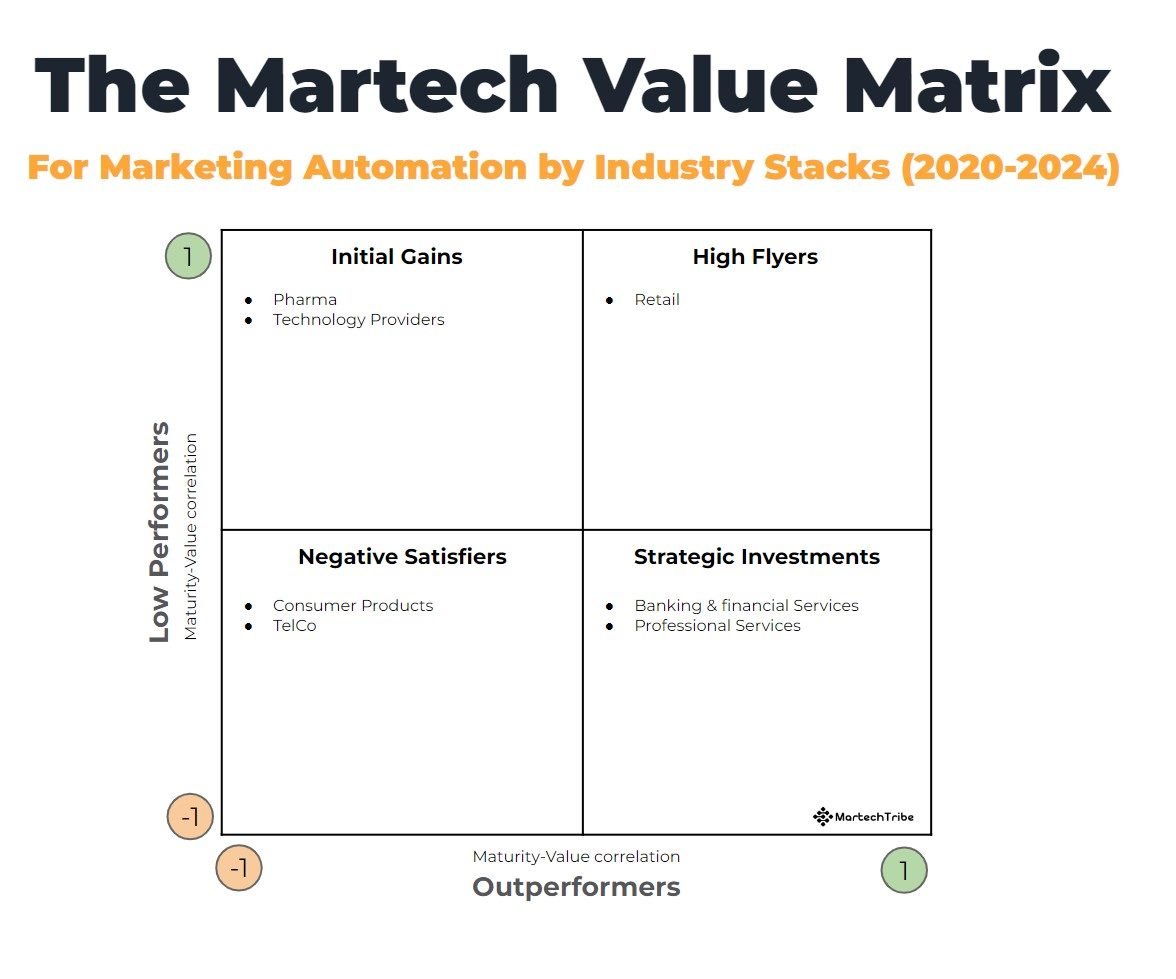

By comparing the results for both top and low performers, we can determine where higher martech maturity is associated with better business performance and vice versa. The result is the Martech Value Matrix with four quadrants. Below we have an example of Marketing Automation (MAP). The matrix offers a more nuanced view of when certain martech fails and when not.

- For Retail MAP is a highflyer. Both low- and outperformers show a positive correlation when increasing their maturity.

- The level of personalization in Retail is less complex than addressing B2B buying committees, making it a straightforward job to show value.

- The Professional Services and Banking & Financial Services outperforming stacks use MAP as Strategic Martech Investment, whereas low performers struggle.

- Getting it right is a challenge. It takes the right level of maturity to get the optimization right between personalization and email frequency.

- MAP is a Negative Satisfier for low and high performers in the case of Consumer Products and TelCos.

- Although an indispensable solution in a stack, there is an over-engineering hazard. In this case, 64% of the outperformer TelCo stacks include a MAP. That is not a small number. It shows that MAP functions as a cornerstone for the foundational use cases.

- Pharma and Technology Provider low-performer stacks initially benefit from MAP solutions, but outperformers know that their core capabilities are (i.e., have reached the right MAP maturity) and keep optimizing customer experiences from there without rolling out the rest of all the MAP capabilities.

The Martech Value Matrix for TelCo Stacks

We can also use the Martech Value Matrix for plotting martech for a certain industry. Let’s take a look at the fast-evolving TelCo industry. It is characterized by high customer interaction and rapid content delivery, and the maturity of marketing technologies significantly influences performance. Here are the correlations in the same Martech Value Matrix for the TelCo industry.

Reading the matrix clockwise, we see that specific martech performs very differently in TelCo stacks.

- Martech High Flyers: Both outperformers and low performers benefit from increased maturity.

- CMS supports large volumes of personalized content while ensuring regulatory compliance, and integrating with customer service/support systems crucial for TelCos. Any delay in launching a promotion on the website or customer app can result in losing market share.

- CRM provides a strong view of revenue with integrations with Finance and Customer Service and acts as a crucial link between finance systems and customer interfaces, enabling proactive revenue tracking, service and personalized marketing strategies essential for TelCos. This makes (real-time) Data Integration & Tag Management extremely important.

- Strategic Martech Investments: Outperformers benefit, but low performers need to address foundational issues first.

- While outperformers have successfully mastered Customer Experience Service & Success, low performers struggle to optimize this part of their stack.

- Building on the high flyer foundation, outperformer TelCos skillfully construct a sophisticated data stack, incorporating Cloud Data Warehouses, Business Intelligence, Dashboards and Mobile & Web analytics. Effectively processing, enriching and serving vast amounts of customer data in real-time is a challenging endeavor.

- Negative Satisfiers: Pushing maturity in this area can be dangerous. Maybe covering the basic use cases is good enough.

- The TelCo Ad stack comprises Search & Social Advertising (71% prevalence), Display & Programmatic Ads (57% prevalence) and Marketing Automation (64%). While it is crucial for a TelCo stack, it is challenging to leverage effectively for both low- and outperformers. Achieving maturity in these systems requires overcoming significant complexities in integration and real-time data analysis. It looks like outperformers have mastered the capability to use Social Media Marketing & Monitoring to yield similar results.

- Over-engineering Optimization Personalization & Testing results in detrimental results.

- Martech for Initial Gains: Low performers see initial benefits, but gains reduce as maturity increases. In the case of TelCo stacks, there are not many key martech solutions worth mentioning.

Conclusion: Moving Martech Metrics Forward

Clearly, there is a compelling need for martech metrics that prioritize effectiveness over mere efficiency. The Martech Value Matrix provides a nuanced understanding of how martech maturity impacts business performance across various industries.

By focusing on effectiveness, companies can better justify martech investments, align them with strategic goals and ultimately enhance their market position. This shift from efficiency to effectiveness is crucial for martech to demonstrate its true value and secure its place in the modern business landscape.

Learn how you can join our contributor community.