The Gist

- CX as a differentiator. Exceptional customer service in financial services is crucial for building brand loyalty and enhancing customer perception.

- Invest in technology. FSIs are leveraging AI, cloud technology and data analytics to improve customer experience and drive growth.

- Mobile matters more. A seamless and user-friendly mobile app experience significantly impacts brand perception and customer satisfaction.

In a fiercely competitive financial landscape, financial services institutions (FSIs) are increasingly recognizing that customer experience (CX) is their most critical differentiator. As Deloitte reports, both product innovation and impactful customer experiences are key drivers of growth within the sector.

As a result, FSIs are channeling significant investments into areas like artificial intelligence (AI), customer-centric processes and cutting-edge technologies to enhance customer service in financial services.

Throughout 2024, digital transformation has taken center stage, with cloud technology, AI and data analytics driving substantial investments aimed at elevating CX. This trend shows no signs of slowing down, as financial institutions continue to build robust data infrastructures and AI-powered customer service systems to deliver more personalized and seamless experiences.

Which CX investments are most likely to deliver the highest returns? CX4ROCKS and bespokeCX, in partnership with OnResearch, recently conducted a survey to explore customer service in financial services. The findings from this survey identified where FSIs can focus their resources to maximize revenue growth, profitability and customer loyalty. The survey targeted 659 U.S. and Canada customers across the finance industry with a confidence interval at +/- 3.8 with 95% accuracy. Data was collected from July 19, 2024 to Aug. 2, 2024.

How Exceptional Customer Service in Financial Services Boosts Brand Loyalty

The financial services sector boasts a higher percentage of top-performing brands than any other. Nearly one in four customers view their institution as a leading brand, with Citibank and HSBC standing out as top performers. However, industry giants like Chase, Wells Fargo and Bank of America still trail behind.

A customer's most recent support experience is the single most important factor in shaping brand perception and loyalty. When clients receive exceptional support, their perception of the brand improves dramatically, solidifying loyalty. Contrary to earlier assumptions, customers don’t weigh the entirety of their experience equally when evaluating a brand. Instead, they focus on the most recent interaction as a shortcut for brand judgment.

The impact of exceptional support is profound. Customers who have an outstanding support experience are more than twice as likely as those with a satisfactory experience — and a staggering 6.7 times more likely than those with a poor experience (figure below) — to have a positive brand perception.

The same trend holds for loyalty: Customers with exceptional support are 3.6 times more likely to express high brand loyalty than those with satisfactory experiences. Conversely, those who receive poor support are 12 times less likely to remain loyal.

Related Article: 5 Ways to Increase Customer Loyalty

How Top FSIs Deliver Exceptional Support

Now that we understand how critical support experiences are to brand perception, the next step is to break down what makes support exceptional. Customers set the bar high. They expect excellence at every touchpoint. Of those who report an outstanding support experience, 90% say that all their interactions with self-help tools and live agents were excellent (figure below). This is a high standard to meet.

What are top brands doing differently? It turns out they’ve moved beyond the quick case closure as a differentiator. While closing cases quickly is expected, it’s no longer a standout feature. Even though top brands are two times more likely than middling brands — and four times more likely than failing brands — to resolve a case within a day, speed alone isn’t enough.

Elevating Customer Service in Financial Services: Key Elements for Success

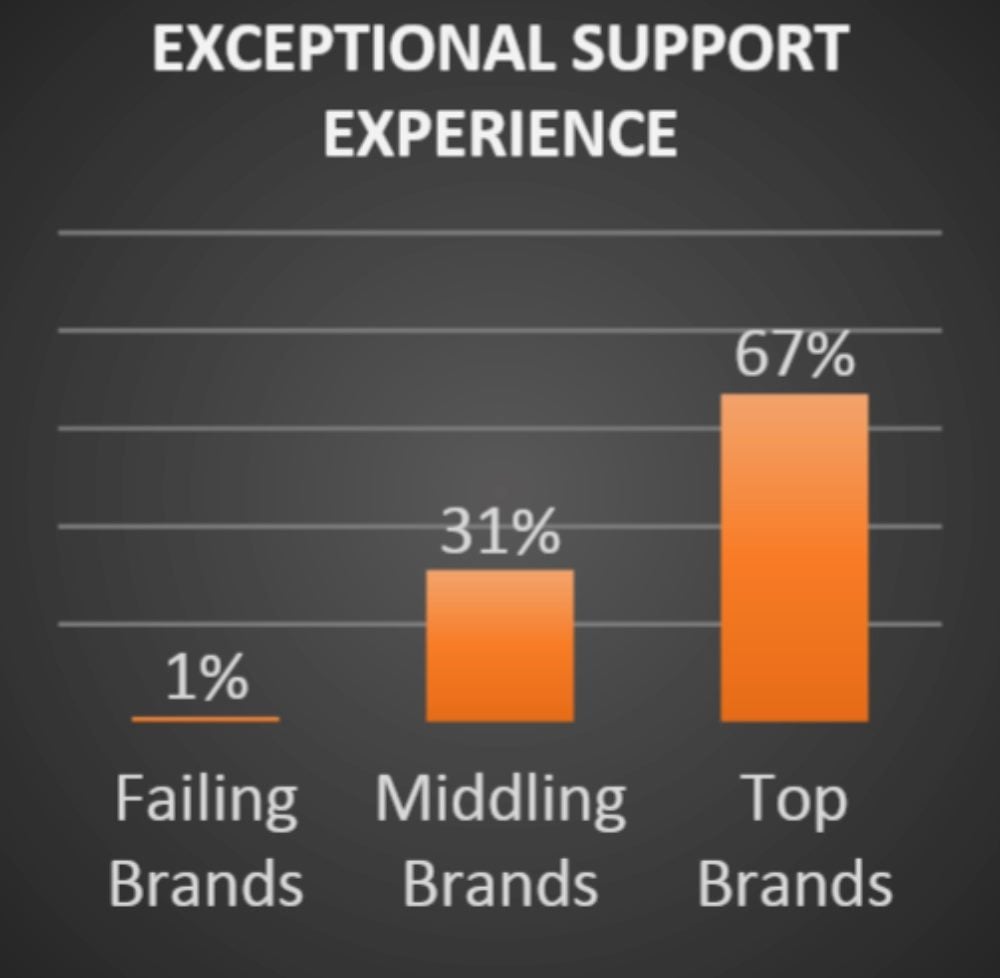

Top-performing brands excel by ensuring that customers walk away feeling that their institution treated them professionally and resolved the issue with minimal effort from the customer. These customers also feel that the brand is deeply knowledgeable about its products, services and customers. Top brands manage to evoke these feelings in seven out of 10 cases, compared to just two out of 10 for middling brands and one out of 10 for failing brands.

What makes a support experience feel professional? There are three key elements:

- Effective communication: All communications — whether from the website, chat, email or self-help tools — must be clear and easy to understand.

- A seamless journey: Customers should be able to transition effortlessly between self-help tools and live agents, whether moving from the app to the website or from a chat to a phone call.

- Compassion: While technology is critical, FSIs must never lose sight of the human element. Customers want to feel understood and cared for, not just have their cases closed.

In addition to these factors, delivering an effortless experience involves three more critical elements:

- Quick responses: Customers expect updates and resolutions within hours, not days. Keeping them in the loop is essential for a smooth experience.

- Well-performing self-help tools: The first point of contact for many customers is often the website or mobile app. If these tools are slow or ineffective, the support experience is doomed from the start.

- Empowered employees: Top brands give their staff the authority to take meaningful action, enabling faster and more effective problem resolution.

The third element of differentiated support is the brand’s knowledge. One of the most frustrating experiences for customers is having to repeat themselves multiple times. Top brands excel at ensuring clients don’t have to rehash information like their name, account number or issue repeatedly.

Related Article: 4 Ways Financial Services Provide Next-Level Customer Experience

Personalization, Channel Preferences and Mobile App Experiences

It’s also important to note that not all support cases are created equal. FSIs generally perform well with account management issues, but handling billing and payment problems is where they struggle. Unfortunately, these are the cases where customers need the most personalized support, and when the brand falls short, loyalty suffers.

Channel preference also plays a significant role. While mobile apps are rarely a preferred communication method — only 5% of customers say they prefer it — two-thirds of these customers used a mobile app for their most recent help request. What’s more, half of them had to use the app four or more times before their issue was resolved. Not surprisingly, customers rate mobile apps as the most difficult channel to use.

However, top brands have recognized the importance of the mobile app as a differentiator. Customers of top brands are 3.2 times more likely to say their FSI’s mobile app is easy to use, making it a crucial tool for enhancing brand perception, loyalty and retention.

For brands that are falling behind, there are clear areas to focus on. Improve communication by hiring effective communicators, reduce wait times at physical locations, ensure websites are easy to navigate and make it seamless for customers to transition between support channels. Empower agents to resolve cases, and most importantly, make sure the mobile app is user-friendly.

By investing in these key areas and technologies, even middling or failing FSIs can elevate their support experiences — and with them, their brand perception and customer loyalty. Focusing on improving customer service in financial services will be essential for brands aiming to elevate customer loyalty and growth this year and beyond.

Learn how you can join our contributor community.