- Customer-first framework. CSAA Insurance Group’s “Customer Experience Triangle” aligns member experience, accuracy, and efficiency.

- AI in action. Virtual assistants, fraud detection, and automation power faster, more accurate claims and interactions.

- Trust through technology. Personalized, seamless journeys strengthen loyalty while optimizing operational performance.

The insurance industry is undergoing a significant transformation, driven by rising costs and the need to deliver value to our customers.

To address this transformation, we at CSAA Insurance Group have developed a framework we call “the Customer Experience Triangle,” which focuses on three key areas: enhancing member experience, increasing accuracy and gaining efficiency.

By leveraging emerging technologies, particularly Artificial Intelligence (AI), we can deliver exceptional transactions that benefit both our customers and our operational performance.

Table of Contents

- Enhancing Customer Experience

- Increasing Customer Transaction Accuracy

- Smarter Workflows, Better Customer Journeys

- Conclusion: Bringing the CX Triangle to Life

Enhancing Customer Experience

Our first goal in the Customer Experience Triangle is enhancing the customer experience. Regardless of the industry, customers expect seamless interaction with companies.

To exceed those expectations and delight our customers, CSAA Insurance Group has implemented a "virtual receptionist" in our voice channel that identifies customers, determines what they need help with and then routes the customer to the right person or self-service capability. This technology allows for simple transactions to be resolved quickly, while more complex issues are quickly directed to the most suitable human agent or claims representative. Customer’s data is carried through the interaction, so they never have to repeat themselves.

The use of emerging technologies is not limited to virtual assistants. It also extends to how we manage our customer data hub to provide even more personalized interactions and communications. This technology allows us to tailor our transactions to meet the specific needs of our customers, providing proactive support and increasing convenience and ease.

Investments in these technologies are driving down our call and digital handling times and increasing self-service adoption, leading to higher customer loyalty.

Related Article: Agentic CX and Marketing: The Future of Customer Journeys

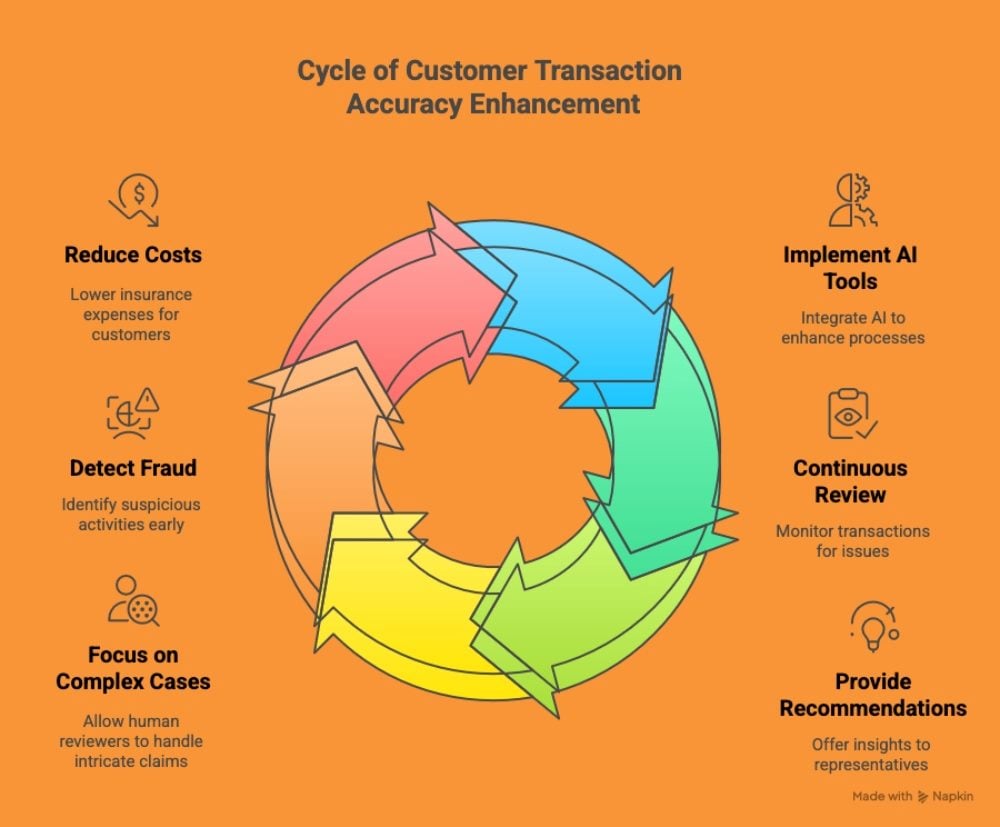

Increasing Customer Transaction Accuracy

Improving transaction accuracy is another key objective in our Customer Experience Triangle, enabling us to process claims correctly and efficiently from the outset. To achieve this, we use AI to improve accuracy in various processes, including claims processing.

For instance, CSAA Insurance Group's virtual claims assistant (VCA) embodies this approach through its "always on quality" feature by continuously reviewing all transactions to identify potential issues and providing recommendations to claim representatives on the next best action to help resolve claims efficiently.

This allows our human reviewers to focus on complex cases and make more informed decisions, ultimately improving the accuracy and efficiency of our claims processing. While VCA is a powerful tool to enhance accuracy, the accountability and decision-making for each claim remains with our claims representatives.

AI is also being leveraged in fraud detection, analyzing claims for patterns and inconsistencies to flag suspicious activity early. This not only helps combat fraud, but it also reduces insurance costs for customers.

Related Article: Is This the Year of the Artificial Intelligence Call Center?

Smarter Workflows, Better Customer Journeys

Efficiency is the third goal of our Customer Experience Triangle. To achieve this, we're leveraging AI and automation to streamline operations, reduce manual processing and enhance productivity. For instance, the implementation of bi-directional texting and digital payments has improved the convenience and ease of interactions for customers.

AI assistants like our Virtual Claims Assistant (VCA) are advancing adjuster productivity by reviewing incoming communications and documents, labeling correspondences and filing them under the correct claim. The VCA also scans through backlogs and highlights critical tasks, helping claims representatives prioritize their workload and focus on decision-making and delivering personalized, empathetic service to customers.

We're also revolutionizing our knowledge management system by leveraging the powerful search capabilities of emerging technologies. They quickly provide information to agents, claims representatives and even customers, significantly reducing the time to find answers and improving transparency.

Customer Experience Triangle at a Glance

This table highlights the three pillars of CSAA’s CX Triangle and the technologies driving results.

| Pillar | Focus | Key Technologies | Customer Benefit |

|---|---|---|---|

| Enhancing Experience | Seamless, personalized interactions | Virtual receptionist, customer data hub | Faster service, no repeat info, proactive support |

| Increasing Accuracy | Processing claims correctly the first time | Virtual claims assistant (VCA), AI fraud detection | Quicker resolutions, lower costs, fewer errors |

| Smarter Workflows | Streamlined operations and productivity | Automation, bi-directional texting, digital payments, knowledge search | Convenience, transparency, empathetic human focus |

Conclusion: Bringing the CX Triangle to Life

The Customer Experience Triangle provides a comprehensive framework that we use to improve customer experience and operational performance. By enhancing member experience through personalized interactions, increasing accuracy through AI-supported processes and gaining efficiency through automation, we deliver a seamless and personalized experience.

Our efforts demonstrate the potential for this integrated approach to build trust, drive customer loyalty and ultimately achieve business success across the insurance industry.

FAQ: AI's Role in Customer Experience Accuracy

Editor's note: Key questions around AI’s role in improving insurance customer experience and accuracy. AI tools like virtual claims assistants continuously review transactions, identify potential issues and provide recommendations. This ensures claims are processed correctly the first time. AI analyzes claims data for patterns and anomalies to flag suspicious activity early. Detecting fraud quickly helps lower costs and protect customers. While AI enhances accuracy and efficiency, complex or nuanced claims still require human judgment. Human reviewers make final decisions, ensuring empathy and fairness in outcomes.

Learn how you can join our contributor community.