The Gist

- Support drives loyalty. Reliable customer support is the top factor in renewing or choosing feedback tools, outranking design and features.

- Scalability is non-negotiable. Every CX leader surveyed said scalability is the deciding factor in shortlisting new providers.

- AI and customization spark change. AI-driven insights and customization options are the capabilities most likely to make leaders switch providers.

Customer feedback tools have become the engines behind smarter experiences. They help companies understand what customers value, where pain points sit and how loyalty is built. From discovery to renewal, these tools now shape the decisions that define growth and competitiveness in every sector.

Table of Contents

- Inside the Customer Feedback Tools Numbers

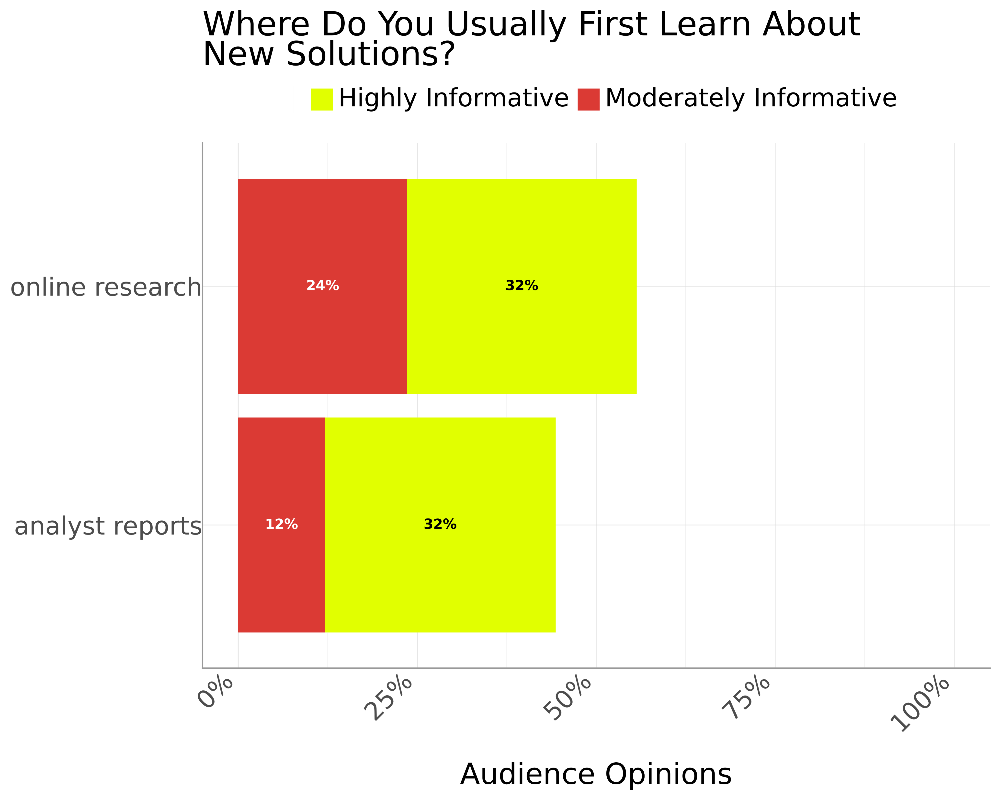

- Where Do You Usually First Learn About New Customer Feedback Solutions?

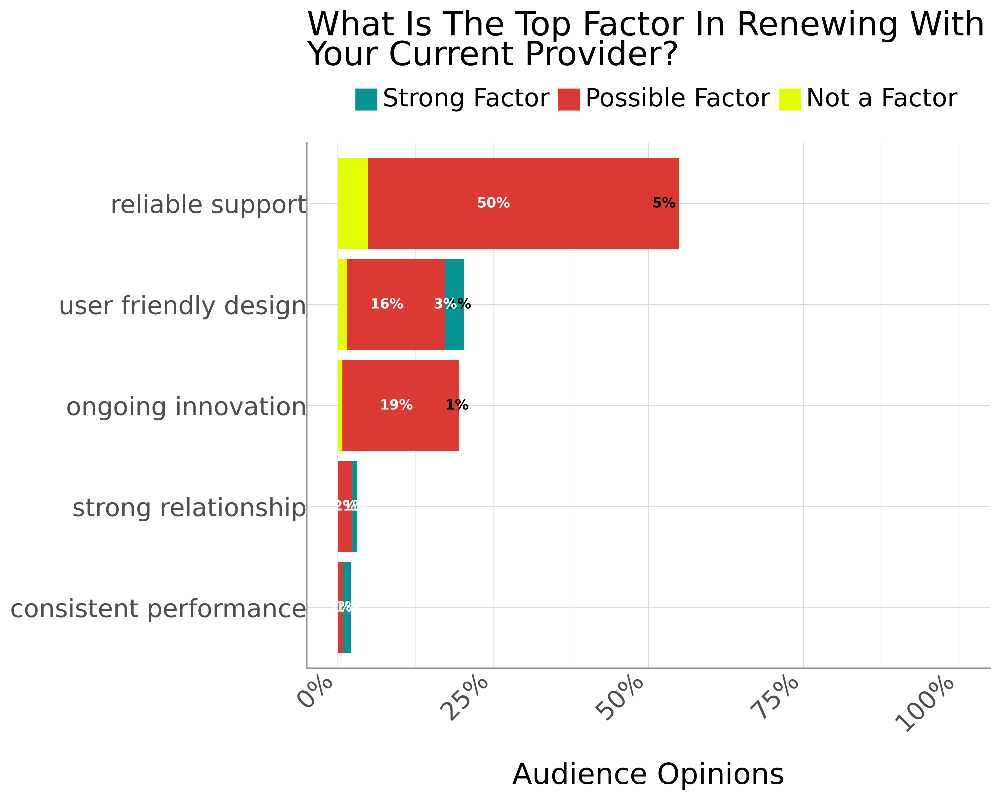

- What Is the Top Factor in Renewing With Your Current Customer Feedback Provider?

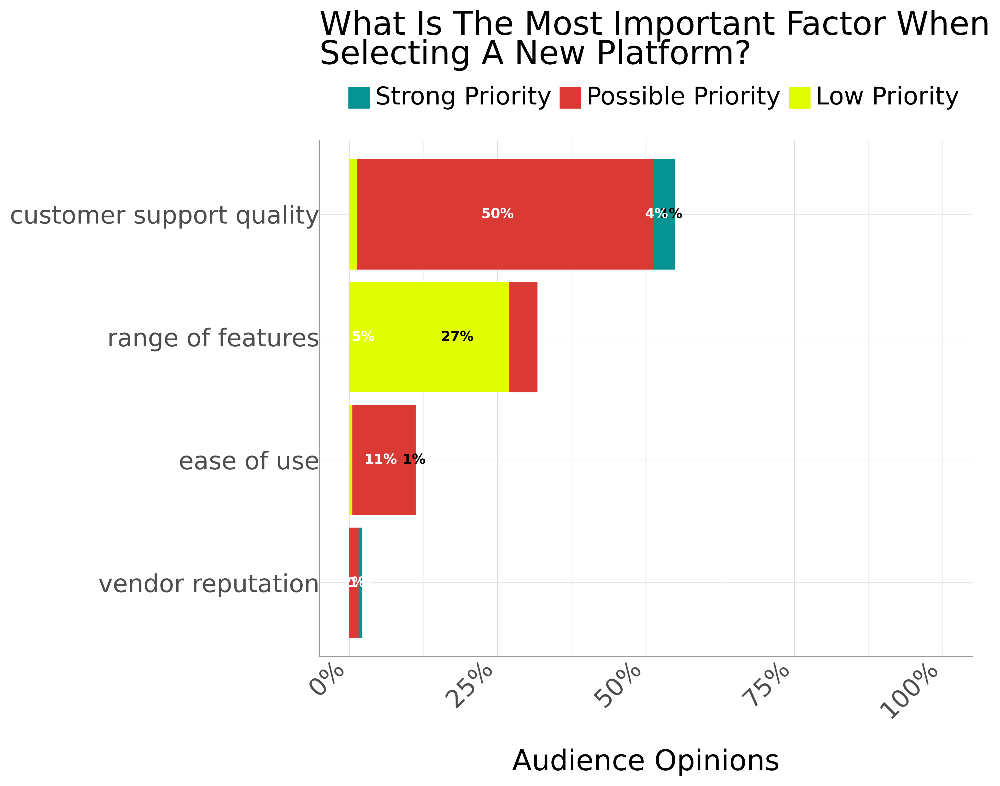

- What Is the Most Important Factor When Selecting a New Customer Feedback Platform?

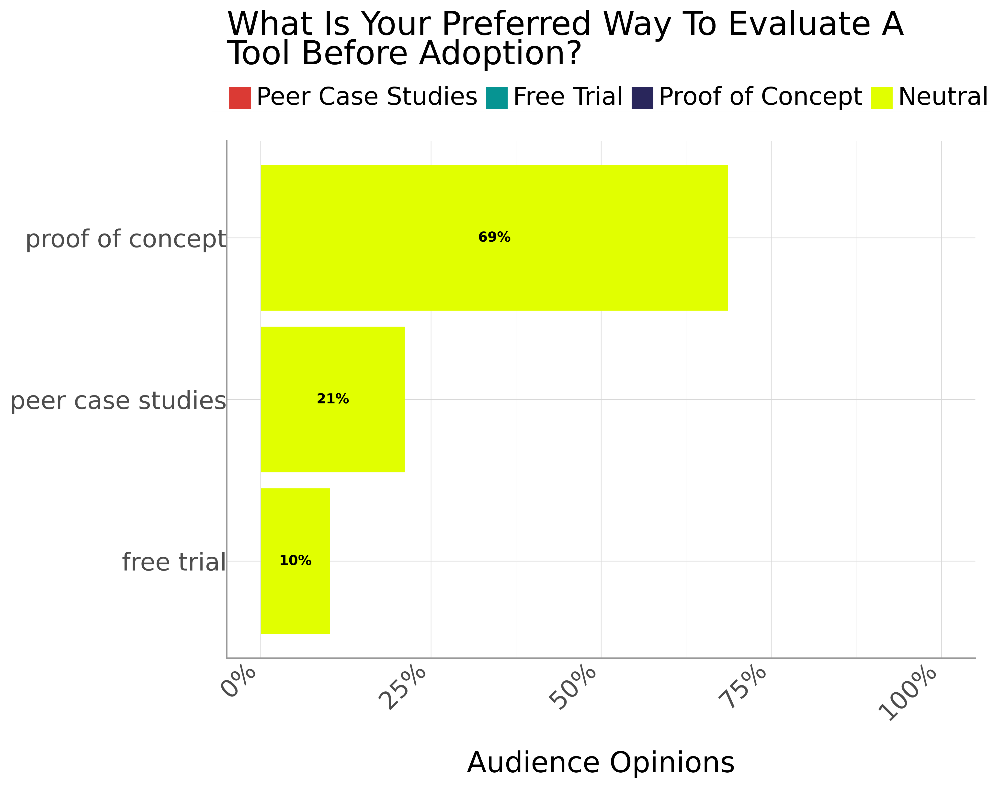

- What Is Your Preferred Way to Evaluate a Customer Feedback Tool Before Adoption?

- What Is the Most Common Reason Your Company Collects Customer Feedback?

- What Do You Consider the Greatest Benefit of a Strong Customer Feedback System?

- What Is Your Biggest Challenge With Your Current Customer Feedback Tool Provider?

- What Type of Customer Feedback Do You Find Most Valuable for Decision Making?

- What Role In Your Company Usually Drives the Purchase Decision?

- Which Type of Data Visualization Is Most Useful to You?

- What Capability Would Make You Most Likely to Switch Customer Feedback Tool Providers?

- A Smarter, More Adaptive Future for Customer Feedback Tools

- Methodology

Inside the Customer Feedback Tools Numbers

Expand the section below to get some insights into the numbers we'll explore today. The methodology behind these numbers are at the end of the article.

-

56% of CX leaders learned about new customer feedback solutions from online research they found highly or moderately informative

-

50% of CX leaders said that reliable support is a possible factor when renewing their current customer feedback provider

-

50% of CX leaders said that customer support quality is a possible priority when choosing a new customer feedback platform

-

69% of CX leaders felt neutral about whether proof of concept was their preferred way to evaluate a customer feedback tool before adoption.

-

Identifying customer needs is the most common reason 47% of CX leaders’ companies collect feedback

-

15% of CX leaders agreed that deeper customer insights were the greatest benefit of a strong customer feedback system

-

Limited features in currently used customer feedback tools negatively impact 23% of CX leaders

-

Social media feedback and product reviews are both potentially valuable types of customer feedback for decision-making for 57% of CX leaders

-

28% of CX leaders said that CX teams offer possible support when driving purchase decisions

-

79% of CX leaders said that journey mapping is the most useful type of data visualization

-

26% of CX leaders said that customer feedback tools are beneficial to them in the healthcare industry

-

26% of CX leaders are strongly positive that customization options would make them switch customer feedback tool providers

Where Do You Usually First Learn About New Customer Feedback Solutions?

56% of CX leaders learned about new customer feedback solutions from online research they found highly or moderately informative

Smart strategies start with smart data:

The CMSWire 2025 State of Digital Customer Experience Report highlights this reliance on structured discovery. It found that adoption of voice of the customer and surveying platforms is widespread — with 67% of large organizations using them compared to just 39% of small businesses. This signals that customer feedback solutions scale differently depending on company maturity and resources.

CX leaders in our most recent research for this article usually discover new customer feedback tools through two main channels: online research and analyst reports. Both are rated highly informative by 32%, but online research edges ahead overall, with another 24% calling it moderately helpful. Analyst reports follow, with 12% seeing them as moderately informative.

That preference comes down to what CX leaders actually trust. They’re drawn to content that’s clear, balanced and feels like it’s coming from people who know what they’re talking about.

Recent research reviewing dozens of studies on what makes online content credible backs that up. It shows that people place more trust in sources that demonstrate expertise, transparency and emotional neutrality. These credibility signals are what make online research and analyst reports such reliable starting points.

What Is the Top Factor in Renewing With Your Current Customer Feedback Provider?

50% of CX leaders said that reliable support is a possible factor when renewing their current customer feedback provider

CX leaders come back for more when the service behind the software actually delivers:

Reliable support is the top driver for renewing current service providers for our audience, with 50% of CX leaders naming it as a possible factor and only 5% saying it’s not. That focus reflects a broader trend identified in HubSpot’s State of Customer Service report, which links fast, effective and personalized support to higher satisfaction, stronger loyalty and even customer acquisition.

User-friendly design was marked as a strong factor by 3%, a possible factor by 16% and not a factor by just 1%, suggesting that while it’s not a dealbreaker, good UX still smooths the path to long-term retention. Ongoing innovation stood out as a possible factor for 19% and not a factor for 1%, showing that while fresh features can create value, they’re more of a bonus than a core expectation.

Strong relationships and consistent performance had limited influence, with just 1% calling each a strong factor. They were seen as possible factors by 2% and 1%, respectively, hinting that trust and reliability are often assumed rather than actively driving renewal decisions.

Related Article: Conquering the Customer Feedback Gap

What Is the Most Important Factor When Selecting a New Customer Feedback Platform?

50% of CX leaders said that customer support quality is a possible priority when choosing a new customer feedback platform

The smart money places its bets on follow-through:

When CX leaders choose a new customer feedback platform, one thing stands out. They want support they can count on.

A full 50% of our audience listed customer support quality as a possible priority and 4% said it’s a strong one. Just 1% saw it as a low priority, showing that dependable service is central to decision-making. That matches recent research, which highlights that in CX tech adoption, support and usability often outweigh sheer technical features. How well a platform delivers on customer expectations is as important as what it offers.

Ease of use gets some attention too, with 11% saying it’s a possible priority and only 1% calling it a low one. It’s a reminder that smooth onboarding and intuitive design still matter, even if they’re not the top draw. The range of features sees weaker traction, with 5% marking it a possible priority and 27% placing it low, suggesting that most CX leaders would rather have a solid core experience than a bloated one.

Vendor reputation has the least pull, with just 1% calling it a strong priority and 2% saying it’s a possible one. In this space, it’s performance over perception every time.

What Is Your Preferred Way to Evaluate a Customer Feedback Tool Before Adoption?

69% of CX leaders felt neutral about whether proof of concept was their preferred way to evaluate a customer feedback tool before adoption.

Seeing is believing, but not all proof carries the same weight:

In evaluating a customer feedback tool before adoption, most CX leaders wanted to see the proof up close. A proof of concept leads the pack, with 69% of our audience taking a neutral stance that signals cautious interest and a preference for controlled trials. Peer case studies carried weight too, with 21% choosing this neutral route, likely looking for reassurance through real-world results.

Free trials come in last at 10% neutral, which lines up with Harvard Business Review’s point that too many free trials are aimed at grabbing new users instead of building on existing interest. They might seem like a quick win, but they often bring in the wrong kind of attention and don’t always lead to lasting loyalty.

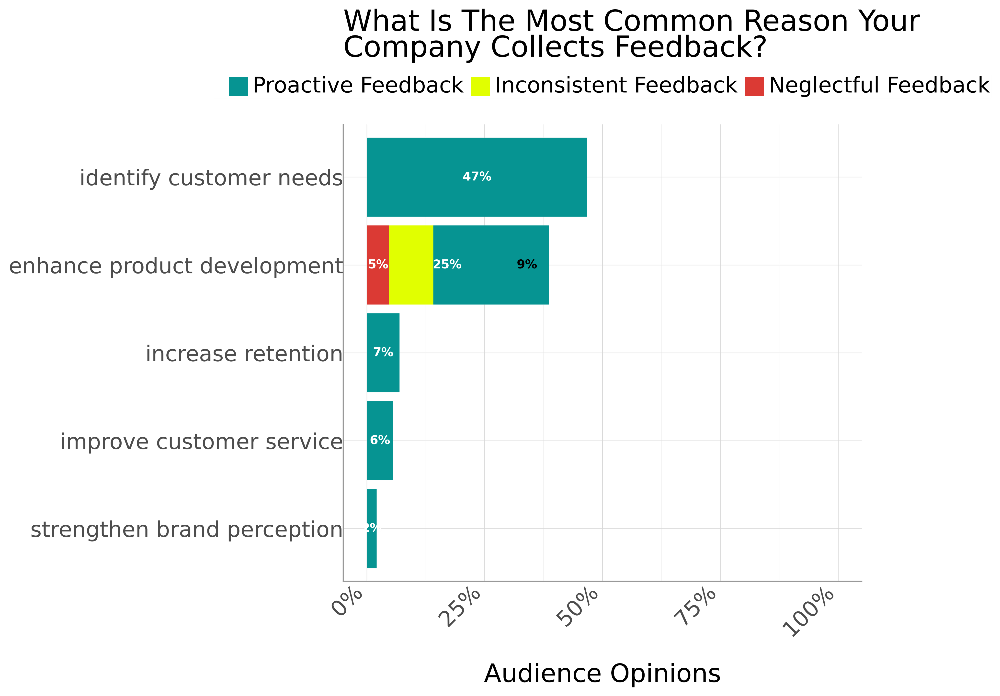

What Is the Most Common Reason Your Company Collects Customer Feedback?

Identifying customer needs is the most common reason 47% of CX leaders’ companies collect feedback

Feedback pays off when it fuels better outcomes:

The most common reasons companies collect customer feedback reveal how they build smarter experiences. The top driver is to identify customer needs, with 47% of our audience using proactive feedback to shape offers around what people actually want.

Another 6% use proactive feedback to improve customer service, strengthening touchpoints that keep people coming back. Together, these efforts pack a punch. Deloitte found that customer-centric companies are 60% more profitable, thanks to better experiences, deeper loyalty and stronger word of mouth.

Proactive feedback also plays a major role in enhancing product development, chosen by 25% of CX leaders, but not everyone’s approach is consistent here. 9% report using inconsistent feedback and 5% describe their efforts as neglectful feedback, hinting at missed opportunities.

Just 7% used proactive feedback to increase retention, even though feedback is a proven lever for loyalty. Only 2% apply proactive feedback to brand perception, suggesting most teams are focused on solving real-time needs rather than shaping long-term reputation.

Related Article: The Loyalty Equation: Trust + Context + Community

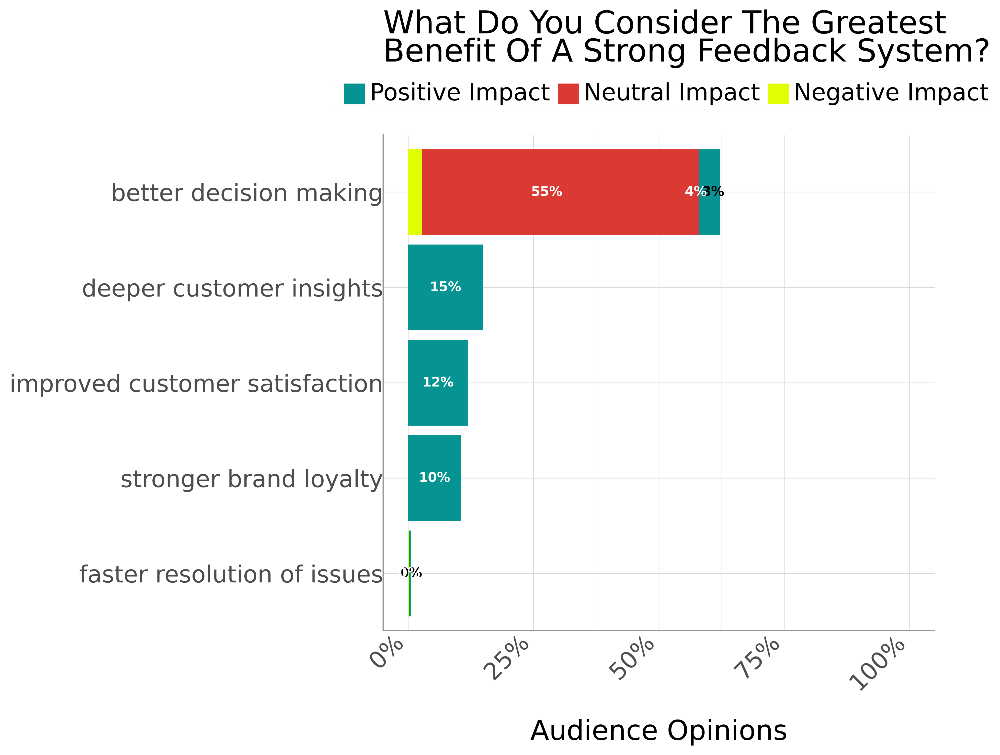

What Do You Consider the Greatest Benefit of a Strong Customer Feedback System?

15% of CX leaders agreed that deeper customer insights were the greatest benefit of a strong customer feedback system

Customer insights only matter if they move the needle:

AI’s role in analyzing and enriching customer feedback is also growing. According to the CMSWire 2025 DCX Report, analyzing customer feedback is among the most common enterprise use cases for generative AI, highlighting how companies are automating sentiment analysis, clustering themes and surfacing insights at scale.

The biggest benefits of a strong customer feedback system show up when input is categorized, measured and tracked over time. That’s when patterns emerge, helping leaders turn raw comments into real clarity.

For 15% of CX leaders, this means a positive impact on providing deeper customer insights that make it easier to understand what customers truly value. Another 12% pointed to the positive impact on improving customer satisfaction, showing how structured feedback loops can lift experiences across the board. Stronger brand loyalty is next at 10% positive impact, reflecting the kind of trust that builds when customers feel their input actually shapes decisions.

Better decision-making is more of a mixed bag. Just 4% of our audience saw it as a positive impact, while 55% called it neutral and 3% said negative impact, hinting that not every system delivers clarity at the strategic level. And while no opinions were expressed on faster resolution of issues, it’s clear that the real payoff comes from turning customer voice into insight that’s repeatable, trackable and trusted.

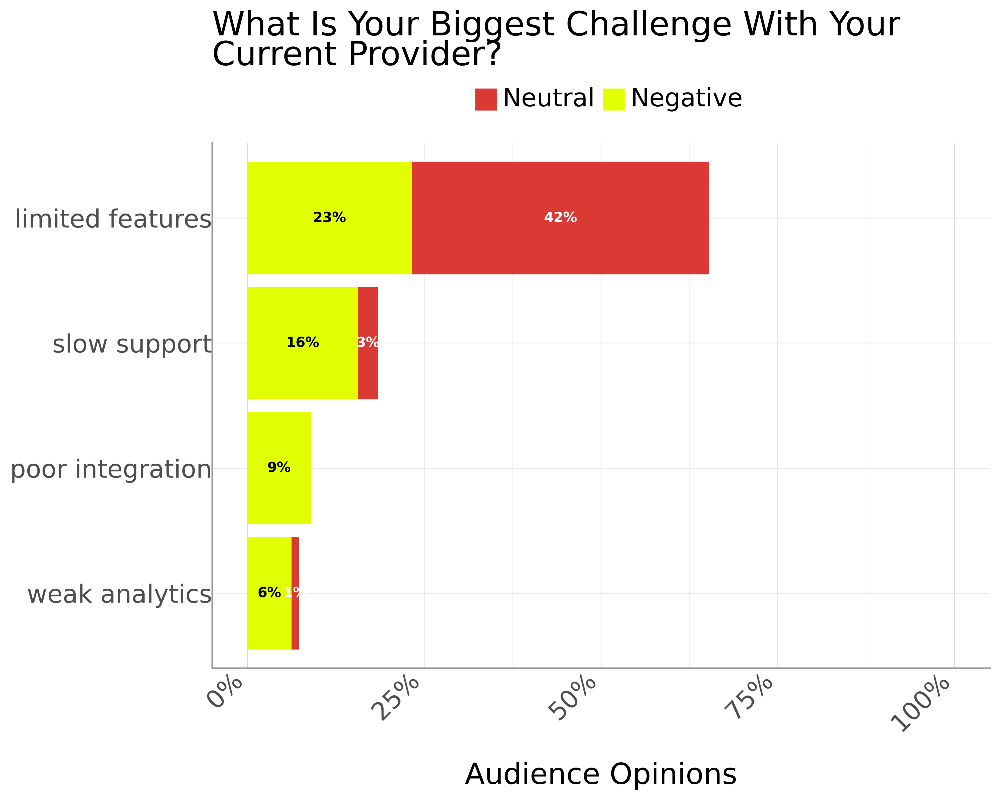

What Is Your Biggest Challenge With Your Current Customer Feedback Tool Provider?

Limited features in currently used customer feedback tools negatively impact 23% of CX leaders

The cracks start to show when tools can't keep pace:

The CMSWire 2025 Digital Experience Platforms (DXP) Market Guide also points to integration as a recurring theme. Many digital experience platforms are embedding feedback hub APIs to centralize survey and response data, ensuring feedback tools aren’t siloed but flow into broader customer experience orchestration.

When CX leaders talked about their biggest challenge with current customer feedback tool providers, limited features topped the list. For 42%, they’re a neutral sticking point, while another 23% report a negative impact, especially when tools lack depth or adaptability.

Slow support is also on the radar, seen as neutral by 3% and as a negative by 16%, highlighting just how valuable responsive, well-equipped support teams really are. Poor integration is seen as a negative by 9%, often blocking visibility across systems. Weak analytics sits lower, but 6% still report a negative impact and 1% remain neutral. Whether it’s speed, scale, or smarts, support needs to be built in, not bolted on.

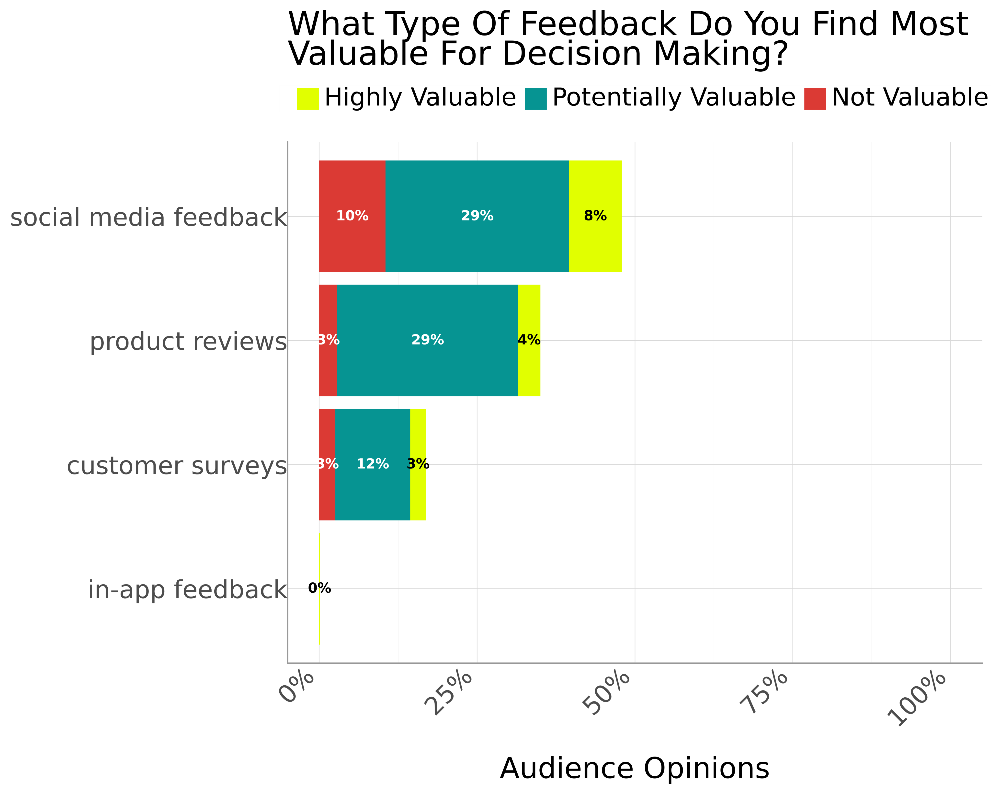

What Type of Customer Feedback Do You Find Most Valuable for Decision Making?

Social media feedback and product reviews are both potentially valuable types of customer feedback for decision-making for 57% of CX leaders

Different types of feedback bring different kinds of clarity:

The type of customer feedback that proves most valuable in decision-making depends on how naturally it fits into the customer’s journey. The strongest systems blend direct responses, like surveys, with indirect signals from social channels and community spaces, giving a more rounded view of what customers actually feel.

Social media feedback led the pack, rated highly valuable by 8% of our audience, potentially valuable by 29% and not valuable by 10%. It’s spontaneous, public and emotionally charged, which makes it especially useful for gauging sentiment. Product reviews follow closely, seen as highly valuable by 4%, potentially valuable by 29% and not valuable by 3%, offering structured reflections that spotlight recurring themes.

Customer surveys come next, rated highly valuable by 3%, potentially valuable by 12% and not valuable by 3%. They may carry lower emotional weight, but their clarity and scalability make them a reliable tool for benchmarking and tracking trends over time. In-app feedback didn’t receive any responses, suggesting its reach may still be limited.

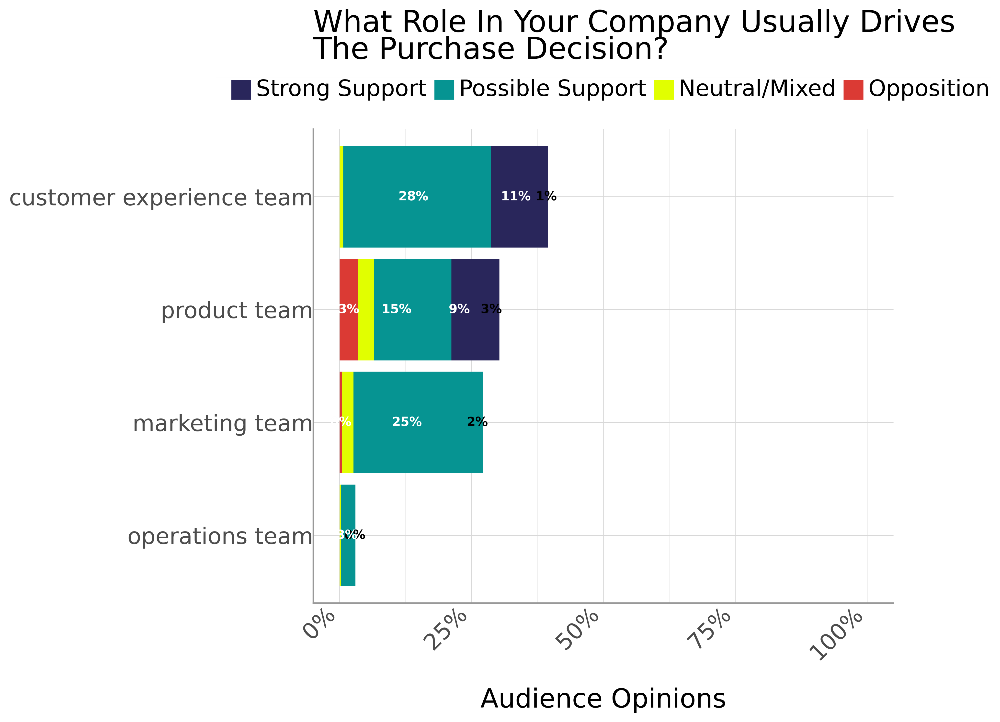

What Role In Your Company Usually Drives the Purchase Decision?

28% of CX leaders said that CX teams offer possible support when driving purchase decisions

Priorities decide which team gives the green light:

Feedback systems are also closely tied to customer data unification. The CMSWire 2025 Customer Data Platform (CDP) Market Guide highlights that customer surveys are a key first-party data source ingested into CDPs. By combining survey feedback with behavioral and transactional data, organizations can build more accurate customer profiles that power segmentation and personalization.

The role that usually drives a purchase decision on a customer feedback tool starts with the customer experience team. In our audience, 11% of CX leaders reported strong support, 28% show possible support and 1% take a neutral or mixed stance. That makes sense when PwC finds that 73% of buyers said experience is nearly as important as price and product quality.

The product team also carries weight, with 9% strong support and 15% possible support, though 3% lean neutral or mixed and another 3% show opposition. It’s a sign that product priorities can push in different directions.

Marketing comes in with 25% possible support and 2% neutral or mixed, while operations adds 3% possible support. Their input might be lighter, but it lines up with PwC’s idea of the “experience supply chain,” where speed, convenience, friendly service and knowledgeable help all depend on teams working together.

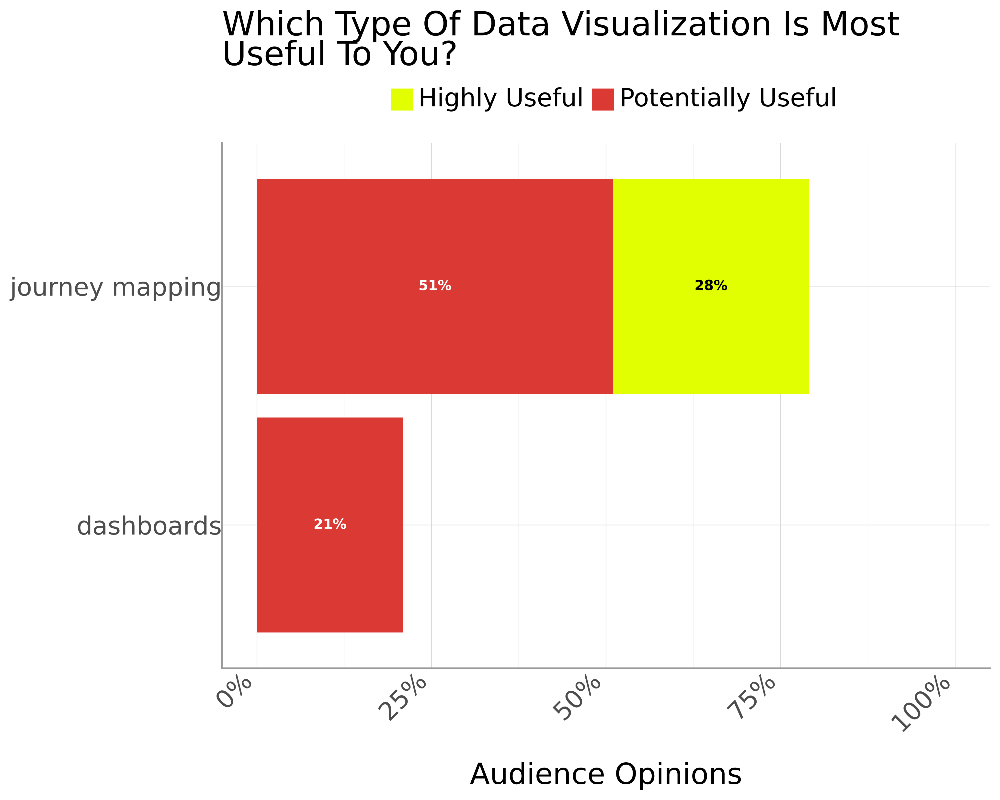

Which Type of Data Visualization Is Most Useful to You?

79% of CX leaders said that journey mapping is the most useful type of data visualization

The right visuals turn noise into signal:

Customer journey mapping is the clear champion among data visualization types that are most useful, with 28% of CX leaders rating it as highly useful and 51% calling it potentially useful. This makes sense when Deloitte said that the most powerful visualizations are those that unlock key values and reveal hidden patterns, which is exactly what journey maps do so well.

Dashboards still matter, with 21% seeing them as potentially useful, especially when they are well designed and aligned to highlight the right insights, echoing Deloitte’s warning that form must serve function to truly engage users.

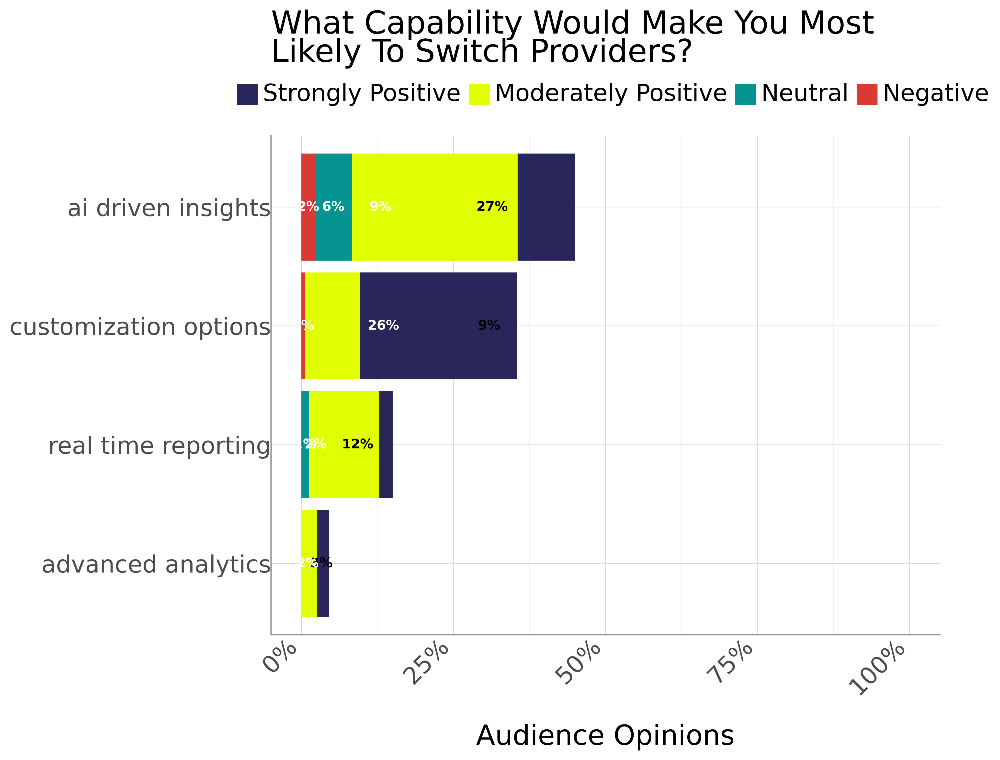

What Capability Would Make You Most Likely to Switch Customer Feedback Tool Providers?

26% of CX leaders are strongly positive that customization options would make them switch customer feedback tool providers

The real draw lies in features that change the game:

The capability that would make our audience most likely to switch customer feedback tool providers is rooted in the promise of smarter, more adaptive systems. AI-driven insights lead the way, with 9% of CX leaders strongly positive, 27% moderately positive, 6% neutral and 2% negative. Their appeal mirrors a broader shift in the feedback space, where AI is being used to capture responses in real time, analyze tone and sentiment and push beyond static surveys toward continuous and more nuanced feedback.

Customization options also carry weight, with 26% strongly positive, 9% moderately positive and 1% negative. The ability to tailor a tool to different channels and contexts reflects the growing demand for flexibility in how feedback is gathered and applied. Real-time reporting shows 2% strongly positive, 12% moderately positive and 1% neutral, pointing to the value of speed in surfacing insights the moment they matter.

Advanced analytics records 2% strongly positive and 3% moderately positive, hinting that while depth has appeal, it is most powerful when paired with features that make findings faster and more actionable.

A Smarter, More Adaptive Future for Customer Feedback Tools

Customer feedback tools are at the heart of how companies listen, learn and act. The opinions of over 1.6 million CX leaders show which tools deliver the most value, which features inspire change and which choices drive loyalty.

Together, their insights point to a future where customer feedback tools become smarter, more adaptive and central to the way customer experience is shaped.

Methodology

To find out what 1,652,692 marketing leaders in America's opinions were about the best brand messaging consultants, we utilized AI-driven audience profiling to synthesize insights from online discussions for a full year, ending Sept. 8, 2025, to a high statistical confidence level. Their views uncovered the factors that influenced adoption, the features that drive change and the trends that will set the pace for customer feedback tools in the future.

Sourced using Artios from an independent sample of 1,652,692 United States CX leaders’ opinions across X, Reddit, TikTok, LinkedIn, Threads and BlueSky. Responses are collected within a 95% confidence interval and 3% margin of error. Results are derived from opinions expressed online, not actual questions answered by people in the sample.

About the representative sample:

-

44% of US CX leaders are between the ages of 45 and 64.

-

54% identify as male and 46% as female.

-

39% earn between $200,000 and $500,000 annually.