The Gist

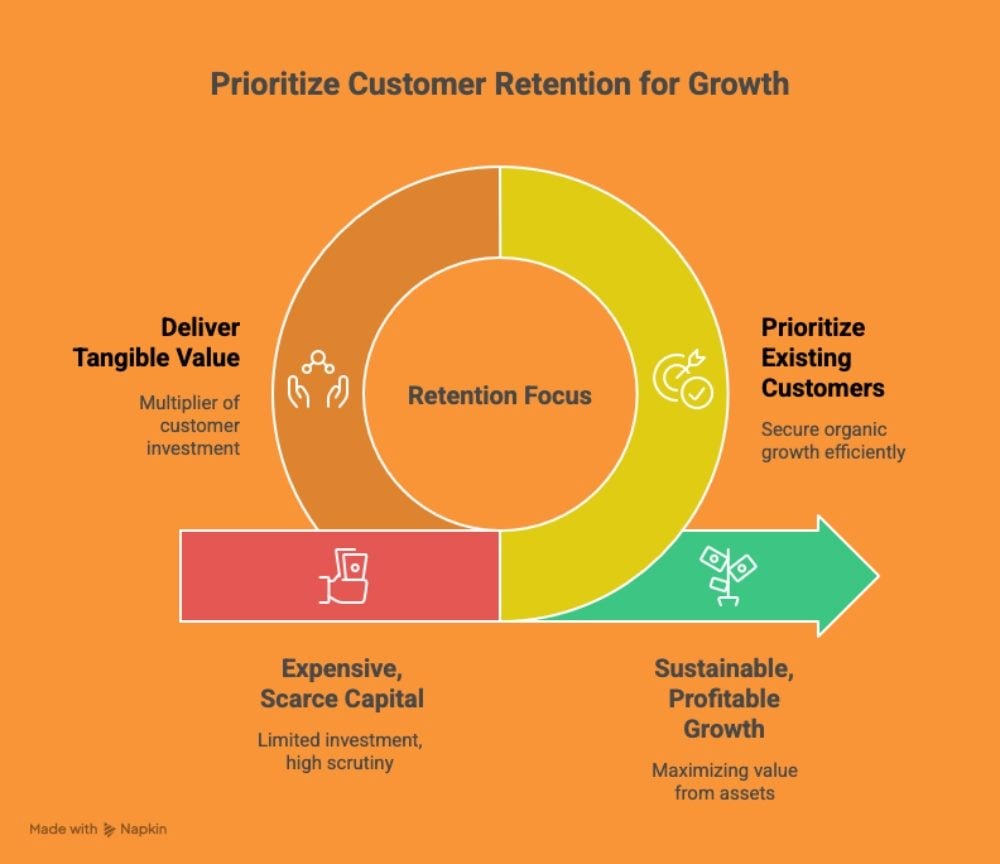

- Capital’s new reality. Expensive capital and the high cost of customer acquisition demand a strategic shift to profitable retention to drive organic growth.

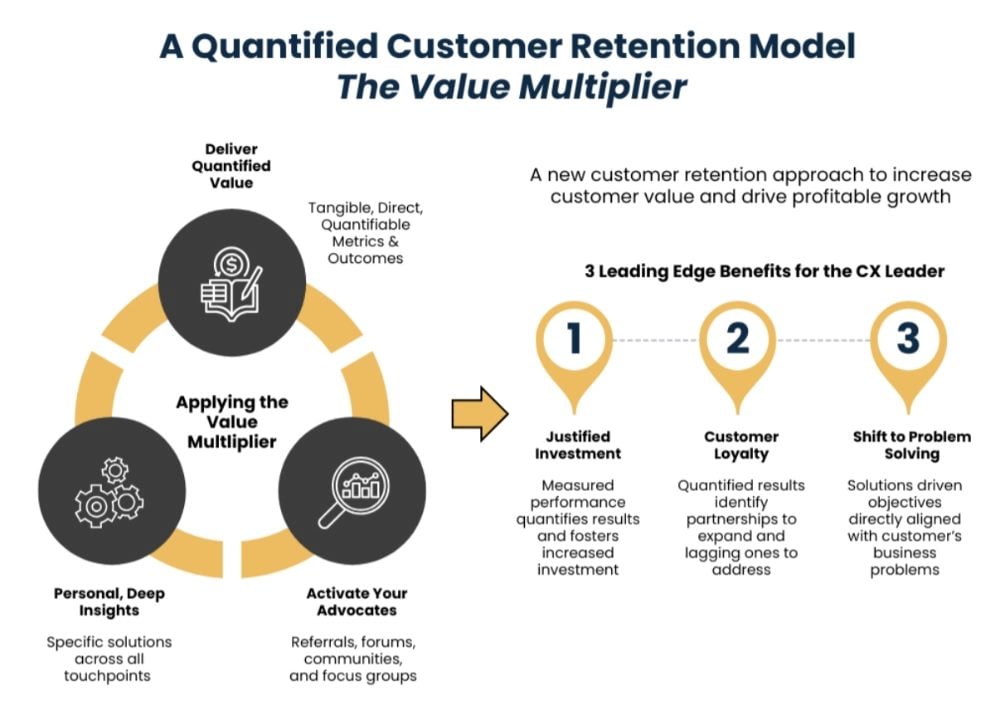

- The value multiplier. A focus shift to delivering quantifiable value brings deep insights and produces a multiple dollar benefit to every invested dollar.

- Activating advocates. The ultimate benefit of the Value Multiplier is transforming loyal customers to increase lifetime value and develop brand advocates.

During the era of Zero Interest Rate Policies (ZIRP), the working rules for capital, investment and return expectations were far less constricting than they are today. Now, both customers and organizations operate in an environment where every invested dollar must produce a quantifiable return.

But with customer acquisition being more expensive than ever, how can businesses execute a strategy that both expands their customer base and delivers on financial requirements?

The Value Multiplier is a customer retention strategy that increases the quantified value of your existing customer base while unlocking new opportunities for lasting partnerships and organic growth. By alignng your strategy with solving customer problems and delivering measurable performance, you can realign your retention program to meet the business needs of your customers and satisfy the demands of a capital-constrained market.

Let's explore how traditional retention programs can benefit from implementing the Value Multiplier to drive customer value and overcome the capital constraints that we face.

Table of Contents

- Capital’s Relationship with Your Customer

- Customer Retention: 3 Leading Edge Benefits of a Quantified Value Focus

- 3 Ways Your Retention Program Delivers the Value Multiplier

- Arming Your Retention Program with the Value Multiplier to Work for Your Business

Capital’s Relationship with Your Customer

More than any other company asset, it’s capital that most directly dictates your ability to acquire, retain and serve your customers. As ZIRP has ended, both companies and customers have experienced a profound shift in perspective. What was once viewed as an unlimited financial opportunity has now transitioned into a more rigorous and structured approach to investment.

This new reality makes a strategic focus on customer retention more critical than ever. Let’s delve deeper into capital’s relationship with your customer and explore why delivering quantifiable value is becoming the new measure for business success.

Related Article: The Customer Retention Pipeline: How to Seal Leaks and Keep Loyalty Flowing

Demanding a Required Return

The investment landscape is no longer the open, free-flowing environment it once was. As the price of capital has risen, so too has the demand for a healthy, quantifiable return on that investment. With many markets experiencing increased volatility, the required rate of return is now also rising.

This has prompted a significant transition in investment behavior; what was once a more lavish and liberal approach has been replaced with a rigor, structure and cadence built on demonstrating concrete value and investment return.

Capital’s Real Attributes: Expensive & Scarce

The capital landscape is one where the real attributes of capital are both expensive and scarce. As every dollar undergoes intense scrutiny, companies face a crucial dilemma: there is a limited pool of available investment capital, while an increasing number of compelling initiatives are competing for those funds.

This situation renders the "grow-at-all-costs" model unsustainable. Instead, there is a shift toward a more strategic approach that focuses on maximizing value from existing assets, with a clear emphasis on profitability and sustainable growth.

The Customer Shift: The Retention Focus

The new reality of demanding high returns and managing expensive, scarce capital inevitably forces a fundamental shift in how we view and engage our customers. To secure the organic growth needed for survival, companies must now do so more cheaply and more efficiently than ever before.

This is why a focus on customer retention, by prioritizing the existing customer base, aligns the limitations companies face while simultaneously focusing on delivering tangible value that is a multiplier of the customer's initial investment.

Related Article: Customer Acquisition Makes You Famous. Customer Retention Makes Money.

Customer Retention: 3 Leading Edge Benefits of a Quantified Value Focus

The best-performing retention programs aren't just built on strong relationships; they're built on a quantifiable alignment to what truly matters—both to your customer and your organization. More than simply being available to your customer, retention programs that drive tangible value do so by identifying and addressing a real need, whether it's related to revenue growth, expense management or brand loyalty.

Let's explore the three key, leading-edge benefits that a quantified value focus will deliver to your customer retention program.

Retention Is about Numbers: Make Yours Count

Talking about profitability is one thing; demonstrating quantifiable, measured performance is something entirely different. A robust performance measurement program aligned with your retention strategy not only produces results—it justifies every invested dollar and builds a more predictable revenue stream.

Senior executives and investors are no longer satisfied with vague metrics; they are focused on clear performance measures related to revenue, expense and time-to-value. Level up your retention program by introducing a 'Value Equation' that further aligns your efforts with what matters most to the bottom line.

Loyalty Becomes Real With Quantifiable Figures

It's also easy to talk about having "happy customers," but true customer loyalty becomes a quantifiable asset when supported by tangible value. A robust retention program focused on increasing market penetration and loyalty should include metrics related to repeat purchases, cross-sells, up-sells, referrals and reduced churn. With this data in hand, you're not just guessing about customer satisfaction; you're equipped to develop and deploy specific strategies to expand successful customer relationships into lasting partnerships and proactively address those that are lagging. Turn the abstract idea of loyalty into a measurable driver of growth in your retention program.

The Shift from Transactions to Solving Problems

Many organizations mistakenly view customer relationships as purely transactional, a perspective that is no longer a viable growth strategy. A much different approach, one built on a foundation of problem-solving, is the new cornerstone of a successful retention program. Customers initially engage with your company to achieve specific business goals—to increase revenue, reduce operating expenses or improve brand loyalty.

By delivering tangible value that directly addresses these key business areas, you can create a lasting and powerful partnership that ensures retention and drives sustainable growth. This is the ultimate expression of delivering value that is a multiple of their initial investment.

Related Article: The Loyalty Equation: Trust + Context + Community

3 Ways Your Retention Program Delivers the Value Multiplier

Transitioning your retention program from a transaction approach to a value-driven approach delivers on a market-differentiating strategy. In a capital-constrained environment, the Value Multiplier produces a multiple of every customer dollar invested with you while strengthening and setting apart your retention program.

Let's explore three key strategies you can implement right now to unlock the Value Multiplier, overcoming capital constraints in any situation.

The Value Multiplier: Delivering, Not Demonstrating

We are often guilty of routinely focusing on our product or service’s features and benefits. While these conversations have their place, your value proposition must be elevated to focus on what your offering truly delivers: measurable outcomes for your customers. For example, instead of simply claiming a product is "easy to use," reframe that conversation to highlight how it "reduces onboarding time by 50%."

This directly connects your offering to a key benefit for the customer—expense reduction—and provides a tangible, quantified metric that directly applies to their business.

The Value Multiplier: Personalized with Insight

Understanding your customer’s specific needs—and exceeding them with tailored solutions—is a powerful value multiplier. This strategy gets to the heart of personalization, which is a key driver of retention. Rather than focusing on a single aspect of the customer interaction, the forward-thinking approach is to unify all customer touchpoints into a single, cohesive journey.

This 360-degree view provides deep and broad insights that you can tailor value driven solutions, strengthening the relationship and ensuring your offerings remain distinguished and indispensable.

The Value Multiplier: Activating Your Advocates

Retained customers are loyal customers, but the ultimate retention strategy is to elevate those loyal customers to brand advocates. Advocacy is the final value multiplier, driving organic growth when your satisfied, retained customers become your most effective marketers. Platforms such as referral programs, customer communities and focus groups are not just perks; they are powerful forums that empower customers to share success stories where you delivered quantifiable value that solved their most pressing business problems.

Beyond the Features: Integration Defined - The Value Multiplier

This table distills the article’s core concepts on strengthening your customer retention program through the Value Multiplier, enabling CX leaders to drive enterprise performance that enables better business outcomes.

| Strategy Element | Insight | Why It Matters |

|---|---|---|

| Capital’s New Attributes | Post ZIRP, capital is now expensive and scarce. | Investment is now heavily scrutinized with a multiple $ threshold required for every $ invested. |

| Retention: The New Acquisition Model | Investing in acquiring new customers is expensive and has a longer time to value curve than a strengthened customer retention program. | Repositioning your retention program focused on value enables you to expand your existing customer base while driving organic growth. |

| Measured Performance vs. Transactional | Traditional retention programs are driven by intimate relationships as the key driver to value. | Quantified performance not only drives the relationship, it drives the value, particularly if defined by business outcomes relevant to the customer such as revenue, expense and time to value. |

| Happiness is Supported by the Right Metrics | Traditional retention focuses on customer happiness, which is vague and subjective. | The right retention metrics, such as repeat purchases, upsell, cross-sells, and reduced churn, bring insight and context to your program and to your customer relationships. |

| Retention Drives Advocacy | Traditional retention typically focuses within the four walls of the specific customer relationship. | The Value Multiplier in a refocused customer retention program enables your customers to become brand advocates, which helps drive organic growth. |

Arming Your Retention Program with the Value Multiplier to Work for Your Business

Strengthening your retention program with the Value Multiplier creates profitable, lasting partnerships. This strategy will sustain your business through periods when capital is scarce, and it will reposition what many consider a transactional approach to a more forward-thinking mindset.

When loyalty aids retention, it becomes an enabler of organic growth. Commit to the Value Multiplier and consistently apply the key strategies outlined here. You will uncover new, impactful benefits focused on delivering real value and solving pressing business problems, which is the ultimate way to set your business apart in any market.

Learn how you can join our contributor community.