The Gist

- Google is moving from CX influence to CX execution. Gemini Enterprise for Customer Experience positions Google as an orchestration layer that actively guides discovery, service, and transactions—rather than just powering search, ads, or embedded AI features.

- Early wins come from agentic assistance, not full automation. Retailers are seeing the strongest results in complex, high-intent workflows—like guided shopping, order changes, and project-based assistance—where AI augments humans and systems rather than replacing them.

- Control and data governance become the real differentiators. As Gemini-powered agents act on customers’ behalf, CX leaders must decide where authority lives in the stack, how data is learned from and reused, and how much decision-making power they are willing to delegate to Google’s orchestration layer.

When Google announced Gemini Enterprise for Customer Experience at the 2026 National Retail Federation conference, it was more than a new set of AI features. It was the clearest signal yet that Google intends to move from powering discovery to actively orchestrating how customers shop, get support and complete transactions.

Bundling AI Mode in search, new shopping and service agents and a Universal Commerce Protocol that lets agents complete purchases across merchants, Google is asking retailers and CX leaders to let its Gemini models sit in the flow of customer decisions, not just at the edge of the funnel.

Table of Contents

- From CX 'Adjacent' to CX 'Operator'

- Inside Gemini Enterprise for Customer Experience

- Early Use Cases and Results From Retailers

- What This Means for Contact Centers and CX Stacks

- The Data, Privacy and Control Trade-Offs

- How 'Agentic Commerce' Could Reshape CX Roles and KPIs

- From Cost Metrics to Value Metrics

- What CX Leaders Should Do Next

From CX 'Adjacent' to CX 'Operator'

For most of the past decade, Google has shaped customer experience from the edges rather than through a front-line CX platform. Search, ads, and Maps determine which businesses customers discover and how they navigate to stores or sites, while Google Business Profile controls much of what people see about a brand at the decision point.

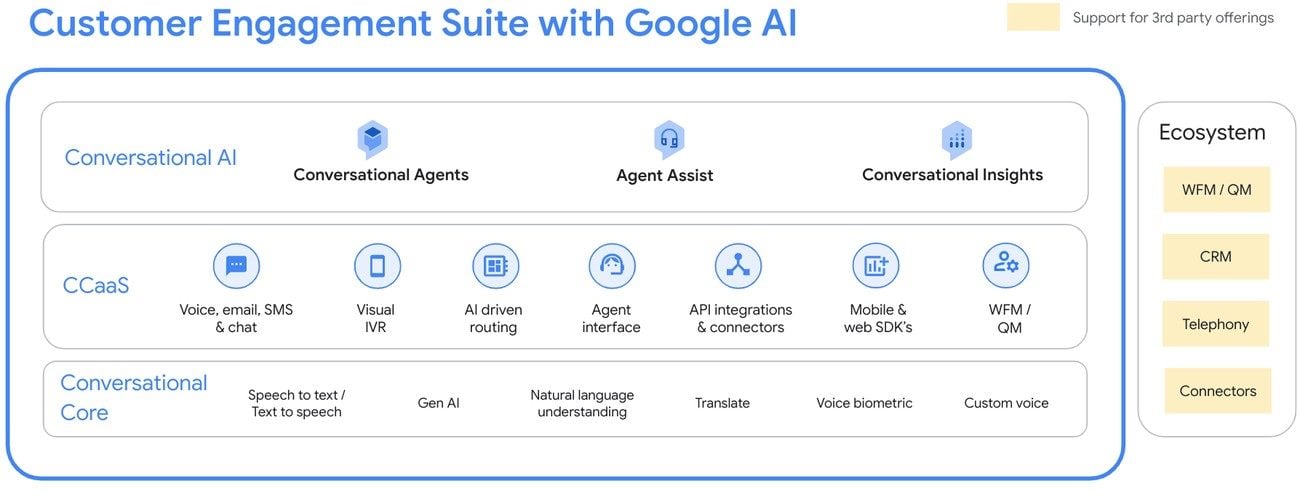

In the contact center, Contact Center AI (CCAI) and Dialogflow CX have typically been embedded inside other vendors’ stacks, providing natural language understanding (NLU) and virtual agent capabilities that connect into platforms including Genesys, Avaya, and Cisco, instead of replacing them as the primary system of record or routing brain.

Gemini Enterprise for Customer Experience, together with the new Customer Engagement Suite and a focus on persistent customer context across channels, signals a different ambition. Rather than simply offering AI components, Google is now packaging Gemini models, Contact Center AI and supporting services into a cohesive engagement platform that can manage conversations, agent assistance and customer data in one place.

That moves Google closer to operating as a CX “control plane” that can coordinate how interactions begin, how they are routed, and how context travels with the customer, instead of leaving that coordination entirely to CCaaS and CRM providers.

The initial emphasis on retail and quick-service restaurants makes that shift especially clear. Coverage of the suite highlights scenarios like digital ordering, in-store assistance and drive-thru or curbside experiences that blend contact center, store operations, and commerce into a single flow, all driven by Gemini and Google AI services under the hood.

Related Article: Google Unveils Gemini Enterprise for Customer Experience

Inside Gemini Enterprise for Customer Experience

At its core, Gemini Enterprise for Customer Experience gives brands a way to plug into Google’s new AI Mode experiences while managing logic and data inside Google Cloud. On the front end, shoppers and diners interact with Gemini-powered “shopping” and “food ordering” agents across Search, Maps, and Android, asking natural language questions, comparing options and completing tasks such as reordering or modifying an order without dropping into a separate app.

How Gemini Enterprise for CX Fits Into the Enterprise CX Stack

This table shows how Google’s Gemini Enterprise positions itself alongside—rather than fully replacing—traditional CX platforms, acting as an orchestration and intelligence layer across discovery, commerce, and service journeys.

| CX Stack Layer | Traditional CX Platforms | Google Gemini Enterprise for CX |

|---|---|---|

| Customer Discovery | Search, ads, brand websites | AI Mode in Search, Maps Android assistants |

| Guided Selling and Ordering | Web forms, apps, IVR, human agents | Gemini shopping and food-ordering agents |

| Conversation Intelligence | NLU embedded in CCaaS platforms | Gemini models and Contact Center AI |

| Commerce Execution | Retailer-specific checkout flows | Universal Commerce Protocol and Agent Payments |

| Systems of Record | CRM, CCaaS, ERP | Remains external; integrates via Google Cloud |

Behind the scenes, Customer Engagement Suite and its agent studio handle the orchestration work: connecting Gemini to product catalogs, store data, support knowledge and policies, then defining which intents the agents can handle and when to hand off to contact center systems or human staff.

One of Gemini Enterprise’s defining characteristics is its ability to retain and apply customer context across channels and interactions, rather than resetting state at every handoff.

Fergal Glynn, AI security advocate and CMO at Mindgard, told CMSWire, "Gemini Enterprise has a single environment that can understand context throughout a customer’s lifecycle; it can remember context from the very first question you asked and use that to help with ongoing support.” Glynn explained that it has generative reasoning, search grounding, and it allows orchestration of workflow together. “Which means, once designed by a team the system can be left alone to adapt answers and actions across channels in a unified manner."

Universal Commerce Protocol and the Agent Payments Protocol sit underneath as the commerce plumbing, giving agents a standard way to check inventory, pass carts to a retailer and initiate payments with auditable consent rather than inventing bespoke integrations for every brand. Gemini Enterprise signals a shift toward systems that reason across data, policies and context in real time, changing how CX teams think about automation and orchestration.

Matt Maher, futurist, speaker and founder at M7 Innovations, told CMSWire, "The real shift here is from intent-based automation to agentic reasoning. Early tools, like Dialogflow, relied heavily on predefined workflows and decision trees, mapping hundreds of potential user intents and routing conversations through scripted paths. Gemini Enterprise introduces an LLM-powered reasoning layer to evaluate content, data signals and policies in real time. Instead of simply answering questions, the system can determine next-best actions and resolve problems dynamically. Now, CX moves from structured automation toward adaptive orchestration—a meaningful evolution from traditional conversational AI."

Early Use Cases and Results From Retailers

Early pilots with Gemini Enterprise for CX are coming through most clearly in grocery and QSR. Kroger is working with Google Cloud on a Gemini-powered shopping agent that plugs into its own digital properties, using AI Mode to move beyond keyword search. Shoppers can, for example, upload a handwritten recipe, have the agent interpret the ingredients, check local availability and loyalty pricing, then build and adjust the basket for a weeknight dinner plan. Google and Kroger both frame this as a way to make list-building and meal planning feel more like working with a digital store associate than scrolling product grids.

Home improvement is another early fit, with Lowe’s using Gemini Enterprise to enhance its ‘Mylow’ advisor so it can guide customers through multi-step projects and reduce returns by improving product selection accuracy.

Where Gemini Wins First: Complex Baskets and Multi-Step Decisions

Early traction with Gemini-powered CX is appearing in scenarios where multiple operational signals must be interpreted together, rather than in simple question-and-answer interactions. Maher explained that "Successful use cases are strongest in scenarios where multiple signals need to be synthesized quickly, such as order tracking, support resolution and fulfillment workflows. Rather than returning static updates, agentic systems can interpret logistics data, inventory availability, customer history and contextual factors like weather or location to propose solutions, like recommending alternative inventory or proactively resolving delays.”

On the restaurant side, Papa Johns is the first brand to deploy Gemini’s multimodal Food Ordering agent across channels like mobile apps, web, phone and in-car systems. The agent can not only take orders, but also suggest relevant upsells, balance value and margin by hunting for deals and give operators menu and performance insights. Google Cloud positions this as a way to centralize menu management and pricing while letting the AI handle routine ordering and recommendation flows at scale.

The Pattern Behind Early Results: Assist Humans, Automate Narrowly

Not all early value comes from full automation. Many teams are seeing returns by layering Gemini onto existing agent workflows rather than replacing them outright. Glynn suggested that "Google Gemini or Google’s new ‘agentic’ shopping and support experiences are seeing early success in the realm of retail, banking and telco providers where agents handle discovery of product, check eligibility of consumers and order changes in one continuous flow. Assisted agent setups are working well, too, with Gemini drafting responses, pulling out policy snippets, and making summaries of long calls, thereby reducing the time needed to handle these things."

Early success with agentic CX tends to appear in narrow but high-impact workflows, while failures often stem from misaligned incentives.

Edward Tian, CEO at GPTZero, told CMSWire, "As examples of where early success with customers has emerged, there are use cases that are narrow but carry a higher degree of leverage through Assisted Product Discovery with a contextual experience that carries over to post-purchase support."

Taken together, these pilots show where Gemini Enterprise for CX is landing first: guided discovery for complex baskets, domain-specific product Q&A, self-service ordering that feels closer to a conversation than a form, and behind-the-scenes assistance that helps humans focus on exceptions rather than routine steps.

Related Article: OpenAI vs. Google: Two Visions for the Future of Agentic Commerce

What This Means for Contact Centers and CX Stacks

Google’s push into CX lands in a market already shaped by heavyweights such as Amazon Connect, Microsoft’s Dynamics 365–based service stack, Salesforce Service Cloud with Einstein and established CCaaS providers such as Genesys and NICE. Those platforms have spent years wiring telephony, routing, workforce management and case management together.

Google is coming at the problem from a different angle: less as a call-routing provider and more as the intelligence layer that understands intent, product context, and next best action across channels.

Google’s Differentiator: Intent and Context Across Surfaces

That differentiation rests on assets its rivals don’t fully match. Google can bring Gemini models together with its Shopping Graph, search, Maps and YouTube data to reason about what customers are trying to do, what they’ve looked at, and what’s available nearby or online at that moment. Combine that with Vertex AI infrastructure and tools such as Contact Center AI, and Gemini Enterprise for CX starts to look like an “agentic commerce” brain that can guide discovery, assemble baskets and orchestrate actions across web, app, and voice, while CCaaS and CRM platforms continue to handle identity, case records and interaction history.

Two Deployment Paths: Orchestration Layer vs. Parallel Front Door

For CX and contact center leaders, the practical question is where that brain lives in the stack. One option is to treat Gemini Enterprise as an orchestration layer sitting on top of existing CCaaS and CRM investments, feeding them intents, summaries, and actions while they remain the system of record. The other is to let Gemini act as a parallel front door for shopping and support journeys that begin on Google surfaces or Gemini-powered web experiences. The first approach maximizes reuse of existing tooling but requires tight integration; the second can deliver fast wins on specific journeys.

For teams already using CCAI or Dialogflow, Gemini Enterprise changes what CX roadmaps prioritize. Maher told CMSWire, "The roadmap shifts from building intent libraries to designing operational playbooks and guardrails. Instead of spending months mapping decision trees, teams will define policies, such as refund limits, escalation rules, and service objectives, and allow agentic systems to operate within those boundaries.”

Maher said that this will also increase the importance of unified data architecture. “Connecting CRM, ERP and knowledge systems into a single accessible layer becomes crucial to deliver critical context for AI to reason effectively."

The Data, Privacy and Control Trade-Offs

This is where things get interesting for CX leaders, because the upside and the risk live in the same place: who sits in the middle of the transaction. Universal Cart and Payments (UCP) and the Agent Payments Protocol are pitched as guardrails: tokenized payments, standard workflows for agent-initiated purchases and auditable transaction trails that make it easier to prove what an AI did and when. In principle, that helps with fraud control and payment security requirements, since assistants can trigger purchases without directly handling raw card numbers. Google is clearly positioning this as safer, more consistent plumbing for agentic commerce.

UCP Creates a New Data Gravity Problem

The trade-off is that more of the interaction exhaust flows through Google. A universal cart by definition centralizes what people browse, compare and buy across multiple retailers, creating a high value dataset about how baskets form, which products get substituted, and how shoppers trade off price versus speed across brands.

Who Owns Customer Truth When an External Agent Interprets Intent?

That raises fundamental questions about control. If Gemini-powered agents own the outermost interaction layer, retailers risk ceding not just execution, but authorship of customer understanding itself. Identity graphs, propensity models, and offer decisioning engines only remain strategic assets if they continue to drive decisions, rather than being reduced to passive inputs into Google’s orchestration logic.

Once an external agent becomes the primary interpreter of intent, context, and next best action, the balance of power shifts. CX and data leaders will need to make explicit choices about where authority lives: which decisions remain governed by their own CDP, journey orchestration, and in-house models, and which they are willing to delegate to Gemini as a policy-enforcing, transaction-initiating brain. This is less about integration and more about who ultimately defines customer truth inside the stack.

Ulf Lonegren, co-founder at Roketto, told CMSWire, "Moving from Dialogflow to Gemini Enterprise shifts you from 'guided dialog' to 'agentic orchestration', instead of just trellises of decision trees like with CCAI (Contact Center Artificial Intelligence), Gemini sits right on the decision tree. And there’s a big visibility gap here: If your digital presence isn’t strong, or is full of negative signals, Gemini might take those to be facts and send a customer to a competitor in mid-purchase."

Who's Customer Data Is It Anyway?

As more customer journeys move onto Google’s infrastructure, the question of data ownership shifts from where data is stored to who ultimately learns from it and controls its use over time. Maher said that "Brands need to approach this strategically. Technically, it’s still their data, but it’s Google’s brain, creating platform dependency over time. The tradeoff: faster innovation and power capabilities in exchange for tighter integration and potential lock in. Brands should think ahead about governance, interoperability and portability, not just whether the tech works today, but how much flexibility they can maintain long term."

Privacy and regulatory constraints add another layer. Routing more journeys and payments through Google infrastructure will intersect with GDPR, CCPA/CPRA, and an expanding list of state and sector rules around consent, data residency and purpose limitation. Retailers that operate in multiple regions will have to verify how UCP handles data localization, retention and subject rights, and whether they can keep enough separation between their own customer records and Google’s broader commerce graph to satisfy both regulators and internal risk teams.

Effective governance requires explicit rules around what data is logged, retained and shared when AI agents operate across customer journeys. Glynn explained that "Most of the journey is based on Google’s infrastructure and brands are benefiting by treating their data as a portable strategic asset. It keeps the record clean and outside the CX layer, sets rules on what is logged and retained and records which events, prompts and responses can be exported or deleted when wanted."

A Question of Governance

In practice, this section of the decision comes down to governance. If CX leaders can get clear contracts, technical control, and reporting that show exactly what data is logged, how it is segmented, and how it can or cannot be reused, UCP and Agent Payments Protocol may feel like a net win. Without that level of transparency, the same features that make agentic transactions easy to audit could quietly shift long term power over customer context away from the brand and toward the platform that owns the rails.

Gemini Enterprise also changes the risk profile of CX by allowing agents to act, not just respond. Tian emphasized that "Gemini Enterprise represents a shift away from the intent detection and bot experience provided by CCAI and Dialogflow, as well as a motion that allows for the ability for a brand's agent to act on behalf of their customer rather than simply responding to them." Tian suggested that the core risk shift comes from delegating authority to AI agents rather than tuning responses.

How 'Agentic Commerce' Could Reshape CX Roles and KPIs

As Gemini-powered agents move from recommendation into full transaction flows, they start to change what “good” looks like in CX. If AI agents can propose a basket, apply loyalty credits, navigate offers across merchants, and complete payment via protocols such as UCP and Google’s Agent Payments Protocol, then classic support metrics such as calls handled, average handle time, or containment stop telling the whole story.

How Agentic Commerce Changes CX Success Metrics

As AI agents move from answering questions to completing transactions, CX leaders must track performance indicators that reflect revenue impact, trust and cross-journey consistency—not just efficiency.

| Metric Category | Traditional CX Metrics | Agentic Commerce Metrics |

|---|---|---|

| Efficiency | Average handle time, containment rate | Agent-led task completion rate |

| Revenue Impact | Cost per contact | Agent-initiated revenue, AOV lift |

| Journey Quality | CSAT by channel | Drop-off during agent-led journeys |

| Consistency | Channel-level QA scores | Cross-surface policy consistency |

| Trust and Control | Escalation rate | Human overrides, agent-initiated refunds |

From Cost Metrics to Value Metrics

CX and support leaders will have to track how often AI agents successfully initiate and complete value-creating interactions. That starts with new revenue-centric indicators such as agent-initiated revenue, average order value on AI-assisted journeys, and incremental conversion lift when an agent guides a shopper compared with a traditional self-service flow. It also extends to experience measures like drop-off rates during agent-led sessions, escalation rates from agents to humans and post-interaction CSAT when AI plays a primary role.

Trust and control metrics become just as important as conversion. Mastercard has framed agentic checkout as a model that will only scale if trust, consent and human override are built in from the start, putting pressure on brands to closely monitor complaints, refund rates, and reversals tied to AI-initiated transactions.

All of this reshapes roles inside CX businesses. Agentic commerce doesn’t just add another bot; it creates ongoing work for conversation designers, bot trainers, AI operations teams and risk and compliance partners who treat agents as semi-autonomous front-line staff. With estimates that agentic commerce could touch between $3 and $5 trillion in annual revenue by 2030, the stakes for who owns these rails are high.

For CX leaders, the real shift is that performance will be judged less on how efficiently they deflect contacts and more on how confidently they let agents act on customers’ behalf without sacrificing control, transparency or long-term customer loyalty.

What CX Leaders Should Do Next

Google’s move from CX-adjacent tools to Gemini-powered CX operations gives leaders new options, but it doesn’t mean rebuilding everything around Google overnight. For now, CX teams should run focused Gemini pilots as extensions of existing journeys, and measure performance against current flows using conversion, average order value, resolution time and CSAT.

Draw the Line on Data and Decision Authority

At the same time, teams must remain explicit about which interaction and transaction data passes through Google and which systems of record they continue to own, because as Gemini moves closer to the center of customer decision-making, that clarity will increasingly determine whether agentic CX becomes a competitive advantage or a long-term dependency.