The Gist

- Understanding CLV's impact. Customer Lifetime Value (CLV) helps brands assess long-term profitability and optimize marketing decisions.

- AI-driven CLV analysis. Businesses are using AI and machine learning to refine CLV predictions, improve segmentation, and enhance marketing strategies.

- Best practices for maximizing CLV. High-quality data, customer segmentation, and adaptive marketing strategies are essential to leveraging CLV effectively.

Editor's note: This piece was updated Feb. 21, 2025 to reflect current information and data.

Customer Lifetime Value (CLV) represents a crucial metric that measures a customer's revenue potential over their entire relationship with a business. Knowing their customers' CLV enables brands to evaluate long-term profitability, guide marketing decisions, prioritize high-value customer segments and optimize resource allocation.

This article will explain what CLV is, why it's an important figure to measure, and provide a step-by-step guide to calculating CLV using basic customer data such as average order value and purchase frequency.

Table of Contents

- When Did Customer Lifetime Value Become a Thing?

- Customer Lifetime Value Graphic Example

- How Is CLV Calculated?

- Best Customer Lifetime Value Practices

- Final Thoughts on Customer Lifetime Value (CLV)

- Core Questions About Customer Lifetime Value

When Did Customer Lifetime Value Become a Thing?

Looking at Customer Buying Habits

Gene Caballero, co-founder and CFO of GreenPal, told CMSWire that understanding their customers' CLV helps them determine their investment in acquiring new customers and retaining existing ones.

"It's vital for balancing how much we're spending on marketing efforts versus the value each customer brings," said Caballero.

The concept of CLV has undergone a fascinating evolution, deeply embedded in the rich tapestry of marketing strategy and customer-centric thinking. The roots of CLV can be traced back to the last century, as businesses began to recognize that the value of a customer wasn't confined to a single transaction but extended across the entire duration of their relationship with a brand.

According to a BuiltIn, CLV has its roots in the direct marketers of the 1970s and 1980s. Peter Fader, a marketing professor at The Wharton School of the University of Pennsylvania, realized that late-night TV marketers devoted a substantial amount of time studying purchase patterns, which led to what they referred to as the “RFM method” — Recency, Frequency and Monetary value. When viewed together (when a customer last made a purchase, how many purchases they made in total, and their average purchase amount), they understood that they had discovered a major indicator of future purchases.

The next step in the evolution of CLV occurred when Dave Schmittlein, dean of the MIT Sloan School of Management, along with two of his colleagues, came up with a mathematical method of converting the historical RFM data into estimates of future CLV. This led to what they called the Pareto/NBD framework, a statistical model that eventually led to what we now refer to as the CLV.

Evolving Customer Lifetime Value: Acquisition, Retention Make Gains

In the early years, CLV was a fairly rudimentary metric. The primary focus was on how much a customer would spend and how often, devoid of more sophisticated variables like customer engagement, loyalty or experience. However, as CRM systems evolved and analytics tools became more refined, businesses started accounting for a variety of factors such as acquisition costs, retention rates and even the likelihood of a customer recommending a brand to others.

“CLV puts a clear monetary value on customer retention. It's more cost-effective to keep a current customer than to acquire a new one, and knowing our customers' CLV has pushed us to enhance our loyalty programs and focus on keeping our users engaged,” Caballero explained.

Things got decidedly more complicated with the advent of digital transformations. The explosion of online interactions in the 2000s and 2010s added intricate layers to the CLV model. The digital world provided new channels for customer interaction, from social media to mobile apps, and each channel would influence CLV differently. At this point, brands could collect data on how a customer navigated through their website, what they looked at, what they ignored and even predict what they were likely to do next.

AI's Entrance into CLV

Artificial intelligence has provided opportunities for an even more nuanced understanding of CLV.

Ryan Elam, founder at LocalEyes Video Production, told CMSWire that many businesses make the mistake of using outdated, static models of CLV.

"Economic shifts, competitive pricing, and consumer sentiment are constantly evolving, making static CLV models obsolete the moment they’re deployed," he said. By using AI to dynamically analyze micro-patterns—such as cart abandonment and engagement length—businesses can update CLV in real time.

With the ability to analyze big data using AI, marketers can now include an array of variables in real-time, making CLV a dynamic metric that can be constantly updated. This provides brands with a wealth of information for customer experience professionals who are looking to not just understand what a customer is worth, but what they could be worth if different engagement strategies are applied.

Michelle Nguyen, product owner and marketing manager at UpPromote, told CMSWire that businesses are using AI and machine learning (ML) to improve CLV predictions through advanced segmentation.

“By feeding historical customer data into AI models, businesses can find granular patterns and trends to better segment their customer base. This lets them identify customer groups with distinct preferences, behaviors, and lifetime value potential,” said Nguyen.

Nguyen explained that these insights allow businesses to create segment-specific marketing campaigns and personalized experiences that increase customer loyalty and CLV. “Businesses need AI and ML to optimize marketing strategies and resource allocation based on the most accurate customer lifetime value projections.”

Related Article: Calculating Customer Lifetime Value Is Tricky

Customer Lifetime Value Graphic Example

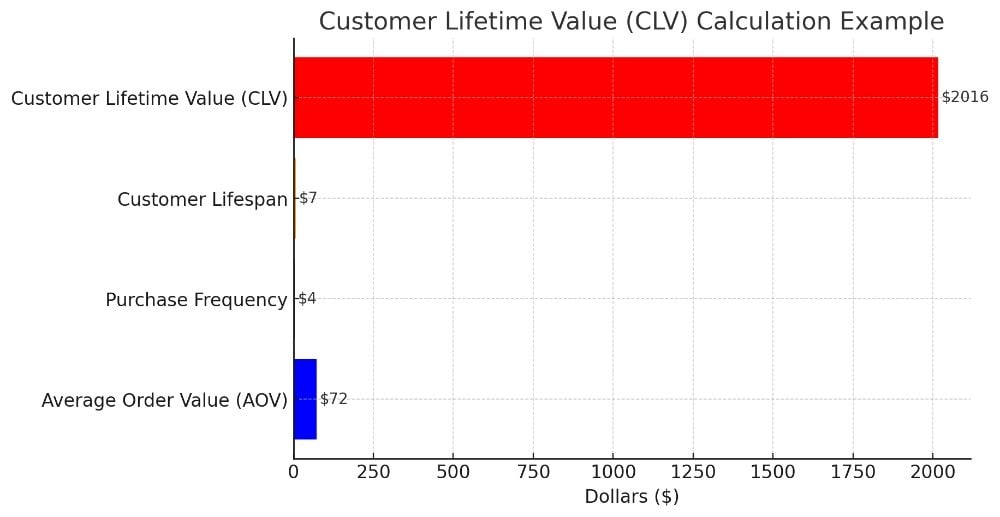

Here is a ChatGPT-created bar chart illustrating a simple Customer Lifetime Value (CLV) calculation example. It visualizes the key components:

- Average Order Value (AOV): $72

- Purchase Frequency: 3 times per year

- Customer Lifespan: 7 years

- Final CLV Calculation: $2,016

This type of graphic can help reinforce how businesses determine CLV and why it's an essential metric for long-term profitability.

How Is CLV Calculated?

Before businesses start calculating their CLV, they must first ensure that their data is accurate and reliable.

Carradean Farley, co-founder Periscope Media, emphasized the need for accurate data in CLV calculations, warning that human error can compromise results.

"To minimize errors, businesses should establish a strong data pipeline from payment providers to CRM platforms," Farley said. By ensuring data accuracy from the point of entry, businesses can trust the insights they derive and make better data-driven decisions.

Calculating CLV might seem like a daunting task, but it's essentially an exercise in combining a few key metrics that most businesses already track. At its core, CLV is calculated by first determining the average value of a customer transaction and then multiplying that by the average frequency of transactions over a given period of time—this determines the customer value per period. The next step is to multiply this figure by the average customer lifespan to get the basic CLV. Thus, the basic formula for CLV is based on three key factors:

- Average Order Value (AOV) – The typical spend per order.

- Purchase Frequency – How often the customer places an order.

- Customer Lifespan – How long they remain a customer.

CLV = Average Order Value x Purchase Frequency x Average Customer Lifespan

If the customer typically spends $72 dollars per order, and places an order every 3 months, and their average lifespan is 7 years, the calculation would look like this:

$72 (Average Order Value) x every 3 months (Purchase Frequency) x 7 years (Average Customer Lifespan) = a CLV of $1,512

i.e. (72 x 3) x 7 or 72 x (3 x 7) = 1,512

For a more accurate representation, brands often factor in variables such as customer acquisition costs, discount rates, and retention rates. Some businesses go a step further by discounting future cash flows to present value, accounting for the time value of money.

CLV with Discount Rate:

CLV = (Average Order Value x Purchase Frequency) x Average Customer Lifespan) / (1 + Discount Rate)

Advanced CLV models may also include elements such as customer engagement and loyalty metrics, churn rates, and even Net Promoter Scores to get a truly comprehensive understanding of what a customer is worth over the course of their relationship with a brand. Overall, the key is to adapt the CLV calculation to the unique facets of a brand’s business model and customer behavior.

CLV with Churn Rate:

CLV = (Avg Order Value) x (1 - Churn Rate) / Churn Rate

These additional metrics can add further dimensions to the CLV model. Incorporating these elements can often yield more nuanced insights, helping businesses refine their marketing strategies, customer relationship management and even product development. While these core formulas offer a reliable starting point, remember that CLV is a dynamic metric. It's most effective when tailored to a brand’s specific business circumstances and updated regularly to reflect changes in customer behavior and market conditions.

Nguyen said that “Businesses are also using AI and ML to enhance the accuracy of CLV predictions.” By analyzing historical customer data, AI can uncover granular patterns, allowing businesses to better segment their customer base. This leads to more targeted marketing campaigns and personalized experiences that drive higher customer retention and lifetime value.

Best Customer Lifetime Value Practices

Ensuring Data Integrity for Accurate CLV Calculations

Data quality is non-negotiable. CLV calculations are only as reliable as the data that is fed into them. Brands must ensure there are reliable mechanisms, such as a modern CRM or CDP, for capturing and updating customer data, and be vigilant about removing outdated or incorrect information.

Nguyen told CMSWire that businesses need strong data governance to ensure accurate, actionable data for long-term forecasting.

“To maintain data integrity, establish clear data collection, storage, and maintenance policies,” Nguyen suggested. “Auditing data sources and performing data quality checks are essential to finding and fixing errors. Adding demographic and behavioral data to internal data can also improve customer insights.”

Not all customers are created equal, and applying a one-size-fits-all CLV calculation can obscure valuable nuances. Brands should differentiate customers by behavior, purchase history, or demographic variables. This allows them to tailor marketing campaigns and customer retention strategies for different groups, maximizing their returns.

Adapting CLV Strategies to Market Changes

Brands should also factor in seasonal trends or economic cycles, as these external elements can impact a customer's likelihood to purchase. An accurate CLV should be responsive to these market conditions. Adapting CLV models to account for fluctuating economic conditions is key to maintaining profitability and long-term customer retention.

Nguyen stressed the importance of flexibility during economic disruptions, and said that “Businesses must adapt their CLV models and marketing strategies to economic disruptions like inflation and consumer spending habits. They use macroeconomic indicators in their CLV models to account for external factors that affect customer behavior and spending.” By closely monitoring customer responses to external changes, businesses can shift their marketing strategies, emphasize value over pricing, and optimize their messaging to address evolving customer needs.

Another pivotal approach is to synchronize CLV with customer acquisition cost (CAC). The cost of acquiring a new customer should be significantly lower than the CLV to ensure long-term profitability. Brands should keep an eye on this ratio, adjusting marketing spend or customer retention strategies as needed.

Turning CLV Insights Into Action

Equally important is to take actions based on CLV insights. It's one thing to know a customer's value, but it’s an entirely different ballgame to implement strategies aimed at increasing that value. Use CLV data to inform customer loyalty programs, personalize marketing initiatives, or even to prioritize customer service resources.

Nguyen told CMSWire that “Proactive retention strategies, powered by predictive analytics, can significantly boost CLV,” said Nguyen. Businesses can use AI to identify customers at risk of churn and offer tailored engagement strategies. Personalized rewards, exclusive offers, and cross-sell opportunities help nurture long-term relationships and maximize lifetime value.

Brands must keep in mind that CLV is not a 'set it and forget it' metric. Market conditions change, customer behaviors shift, and product offerings evolve. They should regularly update CLV calculations to ensure they reflect current realities and feed into a process of continuous improvement.

Related Article: Top Customer Experience Metrics That Matter Today

Final Thoughts on Customer Lifetime Value (CLV)

Customer Lifetime Value represents a crucial metric that allows brands to assess true customer profitability and in turn, optimize marketing strategies for long-term success. While calculating CLV may seem complex, it simply involves combining key data points such as order value, purchase frequency, and customer lifespan. By embracing CLV as a dynamic tool rather than a static metric, brands can build more meaningful and valuable relationships with each customer.

Core Questions About Customer Lifetime Value

Editor's note: Key questions around CLV and its role in business strategy.

What is Customer Lifetime Value (CLV)?

CLV represents the total revenue a business can expect from a single customer throughout their relationship with the company. It helps brands measure long-term profitability and optimize marketing investments.

Why is CLV an important metric for businesses?

By calculating CLV, businesses can allocate resources more effectively, refine customer acquisition strategies, and enhance retention efforts to maximize revenue over time.

How has CLV evolved over time?

CLV started with direct marketing in the 1970s and evolved through statistical modeling, CRM advancements, digital interactions and AI-driven analytics, making it a dynamic and real-time metric today.

How do businesses calculate CLV?

CLV is typically calculated by multiplying Average Order Value (AOV) by Purchase Frequency and Customer Lifespan. More advanced models incorporate retention rates, churn, and discount factors.

What role does AI play in modern CLV strategies?

AI and machine learning refine CLV by dynamically analyzing customer behavior, predicting trends, and enabling hyper-personalized marketing efforts that drive retention and revenue growth.

How can businesses improve CLV?

Businesses can enhance CLV by improving customer experience, implementing loyalty programs, refining data accuracy, personalizing marketing campaigns, and adapting strategies based on economic conditions.