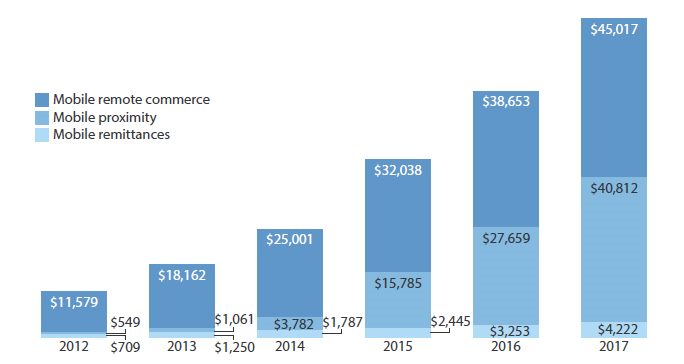

Like paying for stuff with a mobile phone? Then you are part of the zeitgeist, because US mobile payments were nearly US$ 13 billion in 2012, and Forrester predicts Americans will spend US$ 90 billion by 2017 via mobile.

In-store Payments + Mobile Peer to Peer

Forrester analyst Denee Carrington broke down mobile payment into the mobile proximity (in-store payments) and mobile peer to peer (remittances) categories for her "US Mobile Payments Forecast 2013-2017" report.

The report follows the 103rd annual convention and expo of the National Retail Federation, and industry insiders are being ensnared by the siren song of all those potential zeroes, Carrington said in blog post.

Mobile proximity payments are right now the smallest segment of mobile payments, but are expected to grow the fastest. Technologies like near field communications (NFC) fall into this category. Google Wallet is the likely most well known of this group, but other technologies will also help boost this category. Namely, the mobile carrier consortium led Isis project will likely help drive growth in this segment.

Isis Mobile Wallet is an AT&T, Verizon and T-Mobile sponsored NFC payment venture that finally launched its pilot effort in December. Once the full version rolls out around the country, and more phones are released with the NFC chip inside, the mobile proximity payments segment should take off.

That is why Forrester predicts it won't start booming until 2014. 2013 will be the year of NFC deployment and adoption by consumers, apparently.

Mobile proximity payments are predicted to reach US$ 41 billion by 2017, the report noted, an incredible spurt considering it was just US$ 549 million in 2012. People have mostly been using services like PayPal and Square so far, and as more retailers build out their point of sale systems, those payment methods will likely be added as well.

Remittances or mobile peer-to-peer payments, totaled US$ 709 million in 2012, a much higher total than the more hyped mobile proximity category. This will change starting in 2014, but for 2013, it will still outpace mobile proximity payments. Forrester predicts it will hit US$ 4.2 billion by 2017.

A large percentage of the mobile payment growth will come from sources like Google Wallet, PayPal and Square.

Mobile Remote Commerce (mCommerce)

Forrester breaks mobile payments into a third category it calls mobile remote commerce or mcommerce. Think shopping online with a phone (or tablet, though that data is not included in these numbers). This segment is predicted to grow more slowly than the mobile proximity segment, but still be the largest. It could hit US$ 45 billion by 2017.

Driving this growth will be both more people shopping and those people spending more per purchase, a trend already seen in 2012. mCommerce accounted for nearly US$ 12 billion in 2012. As mCommerce becomes more convenient, more secure and more integrated, more consumers will adopt it.

Once that happens, the only thing holding consumers back will be if the mobile payments are not a clearly better alternative to other options. In other words, once the hurdles to adoption get lowered below that point, the numbers will shoot up. Let us know in the comments how much mobile wallet or Square buying you've seen and what websites and stores you've seen it work well in.